Althegh Gold Letly immersed himself earlier this month after the US administration fees. UU., The rebound has since been fast and strong | Photo credit: Krishnendu Halder

The gold brightness has not been attenuated. In fact, the metal shines more than ever in a world shaken by commercial tensions. The yellow metal reached a new maximum of $ 3,245.52 per ounce worldwide last week, while in the domestic market, gold futures marked a record of ₹ 93,940 for 10 grams.

Althegh Gold Letly immersed himself earlier this month after the tariff ads of the US administration., Autumn was largely attributed to the sale of panic in assets and the reserve of profits by investors. The rebound has since been fast and strong, a suggestion that Gold’s long -term bull career is far from finishing.

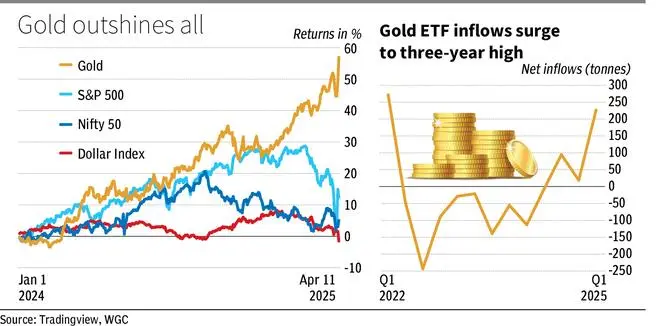

Although the gold and capital markets worldwide have been recovering in recent years, since 2025 there have been considerable sales pressure in stock markets.

However, the bull runs in the yellow metal continues. So what is pushing the price of high precious metals?

To the appeal of paradise

In general, a performance of ascending bonds is not good for gold. Because Althegh Gold and Bonds are seen as safe refuge assets, the interest income of the liter means a greater preference of investors. But just although there was an increase in the United States treasure yields last week, Gold continued after profits.

The reasons for the increase in performance include the inflationary nature of tariffs, the liquidation of the basic trade in the bond market and the potential reduction of the interests of foreign governments due to commercial uncertainties.

Therefore, the argument that when things are bad for equies, people buy bonds simply does not work. All these uncertainties mean gold, seen as a coverage for inflation and a safe refuge, it has only strengthened its case, attracting institutional and retail interest.

A key driver in Gold’s arises is the aggressive purchase of the Central Bank. According to the Gold Council World Cup (WGC), Net Purchases of Central Banks were located in 42 tons in the first two months of 2025. Keep in mind that its net purchase was more than 1000 tons in each of the last three years.

“The central banks around the world have grieved their combination of reserves by reducing exposure to US Treasury bonds. UU. And increasing the allocation to gold,” says Renisha Chainani, director of Research at Augmont. “Not only central banks, but also investors have increased their exposure to gold as seen in the ETF of Gold.”

WGC data shows that Golden ETF inputs reached 227 tons in the first quarter of 2025, the highest quarterly figure in the last three years, which denotes that the feeling of the investor remains optimistic.

Weak $ elevates gold

Another great impulse has come from the drop in the dollar. Since gold, or for any product, has a price in dollars in the international market, a decrease in the dollar can raise its prices. The dollar index has fallen 8 percent in the year when it comes to gold to fly high.

Now, with performance pressure assembly and political uncertainties surrounding the assets called dollars, gold seems increasingly attractive.

Trend ahead

Experts believe that the gold bull is far from finishing.

“We anticipate continuous ascending pressure on long -term gold prices, backed by a weaker dollar, decreasing the treasure yields of the United States and geopolitical tensions with geopolitical communities.

Renisha Chainani adds: “We are likely to see $ 3,300 per ounce of international before the end of the year.”

Posted on April 12, 2025