The Indian residential sector and regulations under the Real Estate Law (Regulation and Development) that work to provide responsibility have been affirmed by the private capital company based in the United States (regulation and development) that work to bring responsibility.

It was a transaction that touched everyone by surprise.

The consolidation in the real estate sector, especially an acquisition, is the unheard of the country.

Specific projects can be acquired or signed joint development agreements, but a fusion and acquisition? No.

Then, when the free asset manager of more than $ 1 announced that he would buy the real estate developer based in Pune in a three -step process, he created a stir and history.

It was even more surprising because Blackstone has so far remained away from the residential segment in India.

Until the advent of Rera and, except for some of the best builders, the sector was infamous for delays and, sometimes, not even delivery of projects.

The country is plagued by incomplete projects as developers run out of funds, they cannot sell houses or fight to approach, which leads to costs of costs.

“… What Blackstone can do, not everyone can. They would probably have realized the potential for the creation of value that occurs on the residential side,” said an investment banker who refused to be named.

“There are people with vision of the future, such as Blackstone, who can execute it,” he added, while seeing it as a unique transaction, instead of a trend.

After Covid, the residential sector has seen a tree and the result in the housing cycle seems to be established.

The deal

The acquisition will give Blackstone a dominant bet, up to 66 percent, in Kolt-Patil.

In the first step, Kolt-Patil will issue 1.27 capital shares in a preferential allocation to a fund managed by Blackstone, which would obtain a 14.3 percent participation in the target company.

The company would be raising a little more than ₹ 417 million rupees in this year.

In the second stage, Blackstone would acquire 25.7 percent of Kolte-Patil promoters, carrying their participation in the company to 40 percent.

According to Sebi’s acquisition code, the company has to make an open offer for at least 26 percent; If all the open sacrifice is completely subscribed, it would take its participation at the planned level.

According to the terms of the agreement, if the preferential problem is not carried out, then Blackstone would acquire more participation of the members of the promoter family, ensuring that it obtains the majority participation you need to administer the company.

On the last Thursday, Kolt-Patil Obweined the approval of the shareholders to issue the shares preference to Blackstone.

With the control of control, Blackstone would be classified as a promoter, but would execute the company in joint control with existing promoters.

The entire transaction would cost Blackstone around ₹ 1,800 million rupees (around $ 209 million), small changes for the company with a portfolio of global real estate valued at more than $ 600 billion, such as or September 2024.

He has invested in residential real estate in North America, Europe and Asia, but remained tied to commercial assets in India: offices, warehouses and logistics, hotels and data centers. Commercial properties are safe because they generate constant cash income and flow.

Market access

What is for the investor?

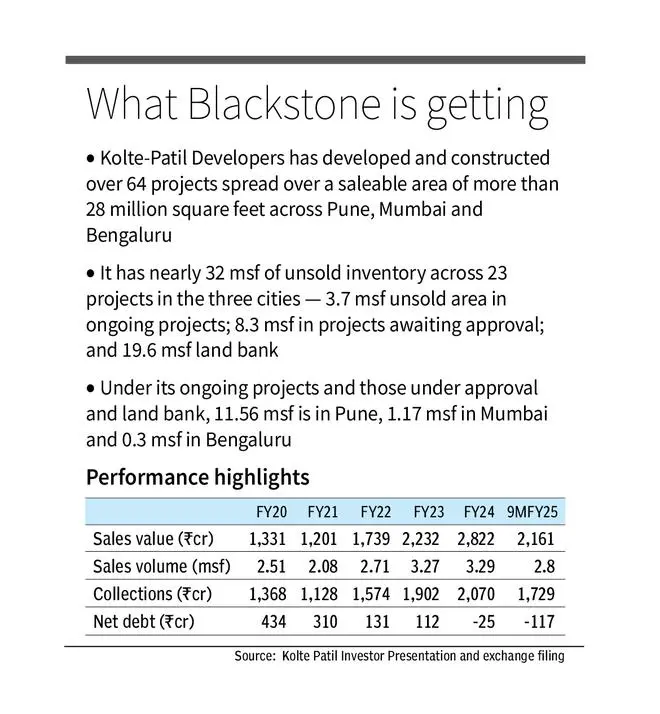

Blackstone will get access to the residential sector in India, starting with the main markets of Pune, Mumbai and Bangalore.

Kolte-Patil has been growing at a constant pace, while investing in processes and people, says Aditi Watve, investment advisor and capital markets, Anarock Group.

“This is a phenomenal history of continuity in an organization, irrepitive of the founding family. It has not happened in Indian real estate that often the perpetuity of the company goes beyond the founding family,” he says, I deal.

Inherited business

Kolte-Patil was founded by Aniruddha Patil in 1970 in Jalgaon, Maharashtra. It was with the development drawn, the townhouses and the bungalows. In 1989, Patil established a base in Pune, and it was here that the real estate business really took off, and his two children joined the company.

He has stayed with the Patil family for about three decades. “While Kolte-Patil may not be the largest in the listing space, they have really raided the way for what can be done,” says Watve.

With the transaction, they have ensured that they can reach the next level of growth, because Blackstone, with their formidable record in the real estate space worldwide, will bring their experience.

“Blackstone can attract the child’s talent that a local developer cannot,” says a broker.

Will you also search the path for similar transactions in the segment?

“If Blackstone does, five other physical education funds will want to do it. Of course, they will first see how this progresses,” says Watve.

It is also to be a Blackstone experiment; If you succeed, you can provide hope to developers who seek to leave or monetize their real estate business.

“You can experiment … you won’t break anyone’s back,” explains Watve. It will be a real test of intention.

More like this

Posted on April 13, 2025