The solvency ratio improved 212.2 percent compared to 191.8 percent in the period of the previous year. | Photo credit: Reuters

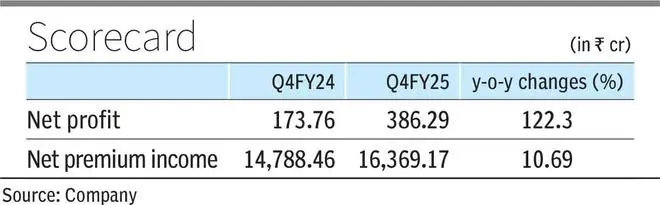

The private sector insurer ICICI Prudential Life Insurance reported on Tuesday a jump twice a year (year -on -year) in her independent net gain to ₹ 386.29 million rupees in the fourth quarter or fiscal year 2015, backed by a fort. Growth.

The company had registered a net gain of ₹ 173.76 million rupees in the period of the previous year.

The net premium income of the company grew by 10.69 percent year -on -year to ₹ 16,369.17 million rupees in the fourth quarter of 200 Althegh, the first -year premium fell 8.05 percent year -on -year to ₹ 2,709.15 million rupees, the renovation premium increased 9.27 percent interannual to ₹ 9.209.209.44 million of rupees for the period under review. The single premium grew 30.13 percent in the year, to ₹ 4,913.04 million rupees.

DIPS management costs

Duration Q4Fy25, insurer management expenses (EOM) stood at 14.7 percent compared to 16.9 percent in Q4Fy24. The solvency ratio improved 212.2 percent compared to 191.8 percent in the period of the previous year.

The 13 -month persistence index fell to 84.3 percent in the fourth fiscal trimester from 87.4 percent in the same period in the previous fiscal year. The persistence of the 49 months increased to 69.1 percent of 67.5 percent in the period of the previous year, in accordance with the presentation of the Stock Exchange. The annualized premium equivalent of the company for the quarter under review fell 3.1 percent year -on -year to around ₹ 3,502 million rupees.

Net earnings for fiscal year 2000 grew 39.6 percent year -on -year to ₹ 1,189 million rupees of ₹ 852 million rupees in fiscal year 2014. The value of new businesses (VNB) for the last prosecutor stood at ₹ 2,370 million rupees, 6.4 percent more in the year.

With a 15 percent growth in Ape to ₹ 10,407 million rupees in fiscal year 2015, the margin of VNB was 22.8 percent against 24.6 percent in fiscal year 2014. The company attributed the fall in the VNB margin mainly to a change in the new commercial profile and assumption changes.

When commenting on the results, Anup Bagchi, MD & CEO, prudential icici Life Insurance, said: “We are pleased to announce that we have crossed 10000 million rupees for the first time, marking a significant mile FY25, demonstrates on March 31 to the delivery of our retail performance.

Posted on April 15, 2025