Archive image: zinc bullions stacked in the Warehouse of the Public Procurement Service in Gunn, South Korea | Photo credit: Seongonon Cho

Zinc prices will probably continue their negative tendency on the weak demand that has been exacerbated by the commercial policies of the president of the United States, Donald Trump, experts say.

“Like other prices of basic metals, the feeling in the Zinc market has affected the bone due to the perceptions of insufficient Chinese policy stimulus measures at the end of 2024 and a weak demand in the United States and the EU,” said the Australian office of the chief economist (AOCE).

“It is likely that the weak demand, exacerbated by Trump’s commercial policy changes, is more under the fundamentals of the market and exert additional downward pressure on prices,” said the BMI research agency, a Fitch Solutions unit.

“High prices of steel coils due to the limited demand of limited zinc of limited national capacity in galvananation,” said the Commercial economy website.

Price forecast

BMI said he was maintaining his zinc pricing forecast by 2025 to an annual average or $ 2,650/ton. This despite the metal, which is used in batteries and for anticorrosion, for a day $ 2,848/ton on the axis to date or April 10.

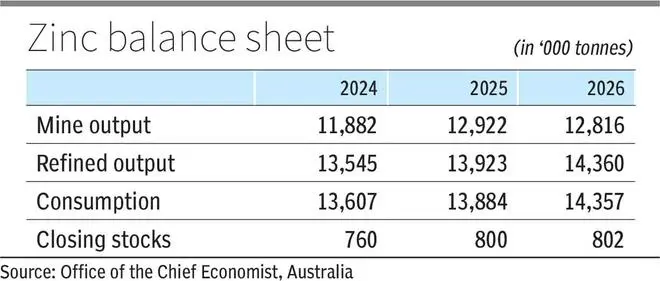

The AOCE said that zins will averaged around $ 2,800 per ton in 2025 before decreasing to $ 2,600 per ton in 2027, due to the softest demand. The World Bank, in its perspective of basic products, said that zinc prices are forecast to fall by 4 percent in 2025 and 2026 as the zinc supply increases.

On Tuesday, the three -month LMI contract ruled $ 2,644.50 per ton. Spot prices are at $ 2,628 per ton. Zinc has lost more than 11 percent since the beginning of the year and more than 10 percent from month to month.

BMI said prices will continue with their descending trend, erasing the profits obtained in 2024. “We anticipate a 5.7 percent decrease in the prices of the annual average of 2024 of $ 2,811/ton as supraint refined and stimulated limits.

Demand side risks

This will probably push the market for an annual surplus or 331,000 tons in 2025, contrasts sharply with the 123,000 tons deficit estimated in 2024.

BMI said the risks associated with Trump’s commercial policies is about to issue downward pressures on zinc prices. “Despite the significant round trip during last week, the scan of 10 percent of Tarly all global imports, which entered into force on April 5, remain in place or on April 10, along with retired rates for China, Mexico and Canada,” he said.

Althegh, recently tax tariffs exclude most zinc products, pose significant risks on the side of demand amid the intense fears of a global recession led by the United States. “We anticipate the volatility ahead as the market actors respond to the continuous flow of developments related to trade,” said the research agency.

On the offer side, the global refined zinc production is prepared for a rebound in 2025, and will cause the lowest prices. This anticipated growth follows a period of contraction in the production of refined zinc, mainly due to the construction of zinc concentrates.

Cautiously optimistic

“We estimate that the global zinc mine production decreased by 0.7 percent year -on -year to 12,000 tons in 2024 of 12,100 tons in 2023, largely due to mines closures triggered by the weak prices environment in 2023 and early 2024. However, our perspective for 2025 is more optimized, projecting a 2.9 percent recovery in the global production of global production in the global production of global production in the global production of global The Zinc mine as a key summary of the BMI key operations.

The research agency said it was cautiously optimistic about the global growth of zinc production, projecting a 2.4 percent increase in 2025. “We have reviewed our demand perspective as fears of a global recession assembly in the middle of the Trump tariff.

However, the AOCE said that the recent announcement of a production cut in the foundry of Zinc of Nystar in Australia, together with the signs of limited concentrate markets, could verify the price drop.

BMI said: “We anticipate that changes in Trump’s commercial policies will press the demand for zinc and highlight the potential of more downward reviews of our demand forecasts in the coming months.”

The international group and zinc supply group (ILZSG), an UN arm, said the initial data compiled by 2024 shows that the global refined metal market recorded a deficit of 62,000 tons. The inventories held in the LME and Shanghai futures exchange stores, along with those reported by producers, consumers and merchants decreased by 31,000 tons for a total of 791000 tons.

Posted on April 15, 2025