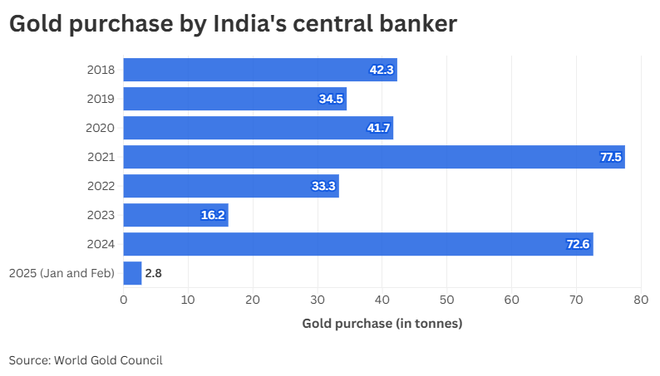

RBI was active during the year, buying gold in 11 of the 12 months and added another 2.8 tons in the first two months of 2025. Photo credit: Istockphoto

As gold prices increase to historical maximums in the back of geopolitical uncertainty, the data shows that the Central Bank of India, the Bank of the Reserve of India, has been an aggressive buyer in the last year, and the proportion of gold in total reserves has almost doubled.

RBI has become the second highest central bank in the world when it comes to buying gold. The data of the Gold Council World Cup show that India bought 72.6 tons of gold in the 2024 calendar year, which increases its total gold reserves by 9 percent. This was the second highest among all central banks. RBI bought was 11 months of the year.

The amount of gold bought in 2024 is also approximately four times the amount it bought in 2023 – 16 tons. Before this, India bought this gold level in the last seven years in 2021, when RBI bought 77.5 tons. In 2025 (January and February), India has already bought 2.8 tons of gold.

Poland was the main buyer in 2024, expanding its reserve in 25 percent with 89.54 tons of gold. Türkiye also added 74.8 tons, which include national commercial banks deposit their gold in the Central Bank.

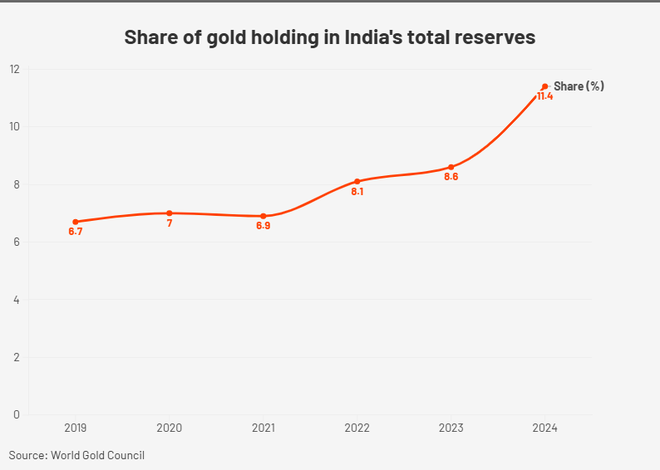

The participation of gold holdings in the total reserves of India has also increased abruptly. This part was 6.7 percent at the end of 2019, 7 percent in 2020, 6.9 percent in 2021, 8.1 percent in 2022, 8.6 percent in 2023 and 11.4 percent in 2024.

Some central banks also reduced their gold reserves in 2024, with the Philippines at the top. Analysts point out that countries generally sell some of their gold holdings in response to economic pressures or to guarantee liquidity in volatile markets.

According to WGC data for April, USA, Germany, Italy, France and Russia have the highest amounts of gold reserves.

The price of gold reached its maximum point at US $ 3,245, its high duration of the high duration of April 14, 2025. With the tariffs of the president of the United States, Donald Trump, increasing the Conns of a possible global commercial war, more investors have liked assets. The gold prices analysis shows that only from the inauguration of Trump only on January 20, the price of gold has increased by more than 8 percent.

In general, the central banks had a high appetite for gold in 2024. The Net Annual Total of gold reserves added by the central banks around the world stood at 1,045 tons in 2024.

“As a result, they have extended their purchase streak to 15 consecutive years and, notable, 2024 is the third consecutive year in which demand exceeded 1,000 tons,” said the WGC in a recent report. “After the colossal buys in 2022 and 2023, net purchases in 2024 exceeded our expectations. Geopolitical and economic uncertainty remains high in 2025 and seems so likely that whenever the central banks turn AD.

More like this

Posted on April 17, 2025