Ather Energy, the OEM or Two-Wheelers (E-2Ws) based in Bengaluru (E-2Ws) is possible to prepare to make public, in a turbulent aerial thought, caused by volatile markets. The company seeks to raise ₹ 2,626 million rupees in growth capital (new problem), while co -founders and institutional investors are partially charging in a sacrifice for the sale that amounts to ₹ 354.8 million rupees. However, Hero Motocorp (HMCL), an important shareholder (39.6 percent participation) and part of the promoter group, is not sold. The promoter group, which now has 54.6 percent (not accounting for the possible dilution by ESOPS), will possess 42.1 percent of the social capital after the public problem. HMCL is simply a capital provider for Ather and there is no technical knowledge among them.

The new theme will be used for the construction of Phase I of ‘Factory 3.0’ in Chhatrapati Sambhajinar, Maharashtra (₹ 927 million purposes.

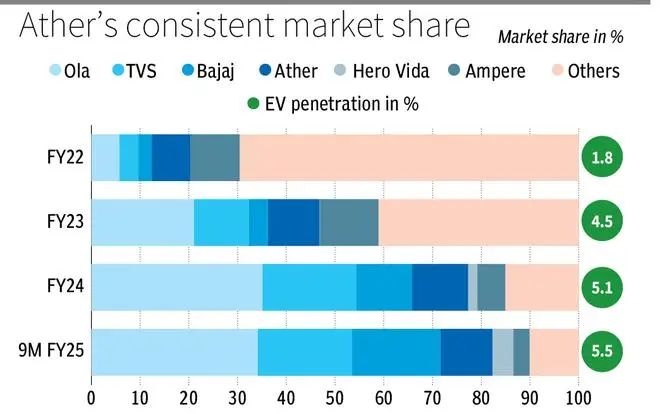

The nascent E-2W industry to which Athe belongs is mature for rapid growth in the coming years, since Indian motorists change the choice of gasoline fuel to electrons. The penetration of EV in the 2W market of India is 5.5 percent for 9 m Fy25 and is scheduled to grow at 35-40 percent in 2031 (through a Crisil report in the RHP). Even better, it is expected that the penetration of the EVs will be 70-75 percent in the segment of the scooters (15.2 percent AS or 9 m fy25), the segment in which it currently works.

A relatively lower TCO (total cost of ownership) to the ICE counterparts (internal combustion engine), a wide range of options in terms of prices and characteristics, state support, impulse in the deployment of public loaders and reducing the cost of batter winds.

Ather’s revenues and the sales volume of FY22-24 vehicles have grown to CAGRS of 107 percent and 116 percent respectively and those of 9 m Fy25 have grown 28.3 percent and 45.3 percent year after year. However, the company has not yet become profitable at the Ebitda level and the loss of Ebitda for 9 m for fiscal year 2015 is -22.9 percent, since it has improved -36.3 percent for fiscal year 200 200

The OPI values the company in a multiple EV/ Income of 4.4x later. Ola Electric Mobility is the only other OEM E-2W Pure-Play, and that is quoted at a multiple of 3.5 times, which was corrected of 5.8x at the time of the opi. Looking for global pairs, Gogoro Inc or Taiwan, which appears in Nasdaq is quoted on Multiple or 1x income. The income of 55 percent of gogoros comes from E-2W Sales and the rest comes from the income generated by the exchange points of operational batteries. Gogoro, too, does not yet have a positive Ebita as Ather and Ola.

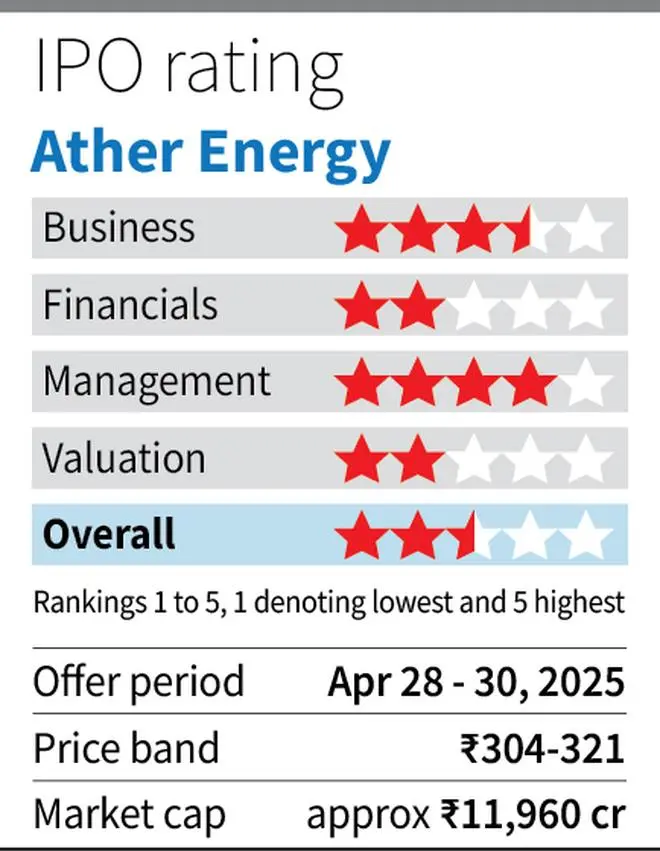

The factors that affect the company favorably and otherwise are delibed in detail below. WHILE THE COMPANY HAS SHOWCASED GOOD GROWTH SO FAR AND HAS GREAT EXECUTION REVISC Live and Companytage and Give the Componstage and Give the Componstage and Give the Componstage and Give the Componstage and Give the Componstage, and Give the Componstage and Give the Componstage and give the partner and partner of the partner and partner and give him five and five five and five five and five and five five and five and five and five and five and five and five and five and five and five Company and five and five and five and five and company. Positive. Looking at penetration numbers, it seems that it could still be a few years. As in the past, the company also has to work in research to improve cost efficiency.

Since this context and the Multiple of ATER valuation, in our opinion, the downward risks far exceed the rewards and, therefore, investors can trace the factors mentioned below, obtain more clarity about the industry and the prospects of the company and look for better entry points.

Business

Ather’s revenues come from three E-Scooters sales currents (88.7 percent in 9 m of fiscal year 2015), sale of services (6.4 percent) and sale of accessories and spare parts (4.7 percent). It currently sells two e-Scooters, the 450 (a performance scooter) and the rhizta (convenience oriented), which have premium price labels. They are directed to the Scooter segment with a price greater than ₹ 1 Lakh.

A lot of hand connected characteristics are in sacrifice of both scooters through the assistance, navigation, safety and integration with Ather Grid (the company’s load network). The company charges ₹ 13,000-20,000 by Scooter as an optional subscription (called propack) to such characteristics for three years and an extended guarantee. Income of these constituents sale of services. About 86 percent of buyers opted for these characteristics in 9 m for fiscal year 2015. Accessories include an intelligent helmet that connects to the vehicle, backup, seat cover and side passage.

Manufacturing facilities

The scooters are held at the company’s hosur factory (TVS supply chain solutions), capable or assembling 4.2 Lakh Scooters per year. This is the second installation of Ather. The first was a closer configuration in Bengaluru, now not used for manufacturing.

Ather follows an asset light model and does not manufacture any internal component other than the battery package, which is the most crucial element of the vehicle. It imports cells of the LG energy solution, Korea, which make the package (it also has a Mou not binding with slit). He thought that the company is not part, is designed internally and only manufacturing is subcontracting. In this way, the company guarantees quality control and the consistency of production. Pieces such as the battery management system and motor controller are crucial for a predictable accelerator output. The code within these pieces and for the software battery is written internally.

Ather plans to build his third factory called Factory 3.0 (has plans for two phases), which will be property. Phase I of the plant is capable of five Lakh vehicles and is expected to begin production from Q2 or Fy27. This plant will house the next platform El (profitable convenience scooters) and the Zenith platform (electronic engines that are directed to the 125-300cc segment).

Things that go for it

Ather products are designed around the customer and customer -centered characteristics differentiate their scooters from their counterparts. The company was the first in the introduction features, such as a touch screen board with Google Maps navigation, fast charging, traction control and fall safety (the energy is cut in case of an accident), to name a few. Ather’s ability to precisely predict the range is widely appreciated in the market and this helps build a strong brand retreat.

Extensive analysis and research supports offers and an efficient assembly line, and this cannot be emphasized enough. About 46 percent of the workforce is dedicated to R&D and the company has intellectual properties on battery, software, chassis, electronics, etc. Intangibles (including developing), which include patents, software, website and those related to product development, represent 9.6 percent of the general balance. R&D spending (both capitalization and spent) to income for 9M Fy25 has 15.1 percent. All this has led to a reduction of pump costs (material invoice) or 31 percent for Atter 450x since its launch in fiscal year 2011. This company of the company could improve the gross margin even when the government reduced subsidies. The participation of income subsidies has decreased from 24 percent in fiscal year 22 to 7 percent in 9 m the fiscal year 2015.

Ather’s battery packages contain NMC cells. The company has investigated in several cell chemicals and has now found viability in LFP cells. While NMC cells are dense in energy and adapt to fast charging, LFP cells cost less and have longer lives. Scooter variants with LFP cells will be sacrificed along the headlines in the future.

While the brand and its 450 model are quite blast in the Seth, Ather now also seeks to take advantage of the northern states, where customer preferences are biased towards the family segment/ convenience. The rhizta was introduced to address this. Rizta now represents 52.5 percent or the sales volume of 9 m for fiscal year 2015.

Costs related to the provision of propack services are largely sunken costs. The greatest adoption of propack by buyers would mean that such income flows directly to Ebitda.

Things that go against

The future of the company and its companions greatly trust if India leads to the EVs or not. FY23 was the first year to see a significant increase in the volume sold and the penetration of EV (4.5 percent of 1.8 percent in fiscal year 2012). The penetration grew only marginally to 5.1 percent in fiscal year 200 and 5.5 percent in 9 m for fiscal year 2015. This comes even when customers flood with a variety of products and prices.

Concerns about the withdrawal of the Government of long -term subsidies, the anxiety of rank, the absence of a network of well -developed public loaders and the lack of deeper clarity about the true life of a battery and the resale value in the minds of consumers could explain this.

The use of the Capacity in the Hosur factory of Ather was 26.5 percent for 9 m scooters for fiscal year 2015 – 1.11 Lakh produced against an installed capacity or 4.2 Lakh. Given this, the company’s current expansion plans may seem too optimistic to compromise capital to develop the capacity of five Lakh more units. While there is a precise case that EVs can prosper in the long term, the road may not be linear and there could be speed potholes along the way.

The industry also lacks competition. The OEM inherited from pocket with the pocket with the distribution pocket, the TVS Motor Company and Bajaj Auto tastes can close the gap with the ATER USPS over time. There is also a group of new companies such as the mobility of the river and the ultraviolet rising from ranges with convincing products, playful for market share.

Posted on April 26, 2025