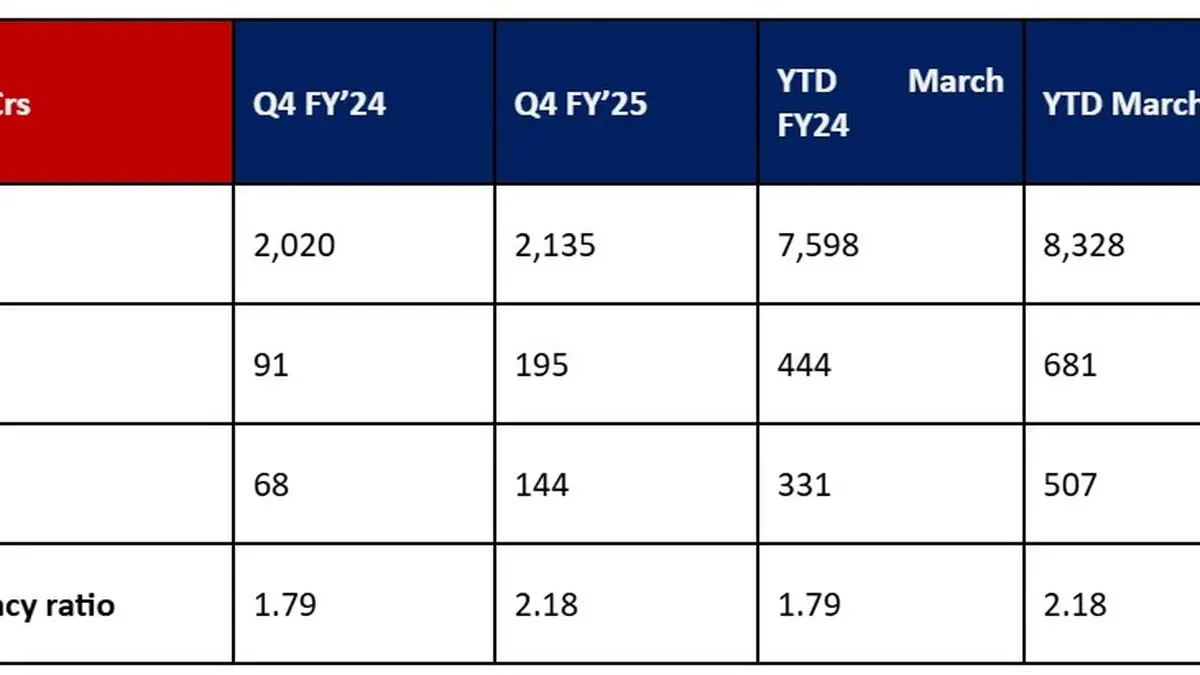

Cholamandalam MS General Insurance Company Ltd (Chola MS), a joint company between the Murugappa group and the Mitsui Sumitom above. In comparison, the company had published a PBT or ₹ 444 million rupees for fiscal year24.

The company written brute (GWP) of the company stood at ₹ 8,328 million rupees, registering a 10 percent growth, which, according to the company’s statement, is higher than the industry’s growth rate.

In compliance with the regulatory change as of October 1, 2024, with respect to the GWP report for non -long -term non -engines, Chola MS has classified premiums related to future accounting periods such as ‘Premium in advance’, ascending to ₹ 249 million rupees.

“We are honored by this progress and we will follow this impulse. We are committed to offering sustainable value to all our interested parties,” said V Suryanarayanan, managing director of the company.

Chola MS concluded the financial year with a net assets of ₹ 2,999 million rupees, 85 percent derives from the profits won accumulated over the years. The company’s return on capital (ROE) for the year was 16.91 percent, an improvement compared to 13.3 percent in the previous year.

Chola MS market share among various line insurance players has increased to 3.15 percent.

The company’s investment corpus has crossed ₹ 18,000 million rupees with greater diversification throughout the portfolio. The solvency margin improved 2.18 times, well above the regulatory requirement of 1.5 times.

In the course of the year, Chola MS expanded his client base, strengthened his network of commercial partners and successful retained all his banks of Bancisio.

The company also recorded an insurance coverage without cultivation in more than 1,68,000 grams of Panchayats in the country, ensuring more than 52 Lakh units/lives. In addition, it managed around 6 Lakh of claims without cultivation for the doors of the financial year.

Chola MS quickly advances from his digital transformation initiatives to improve client experience at all contact points and has made significant progress in this regard, the statement added.

Posted on April 27, 2025