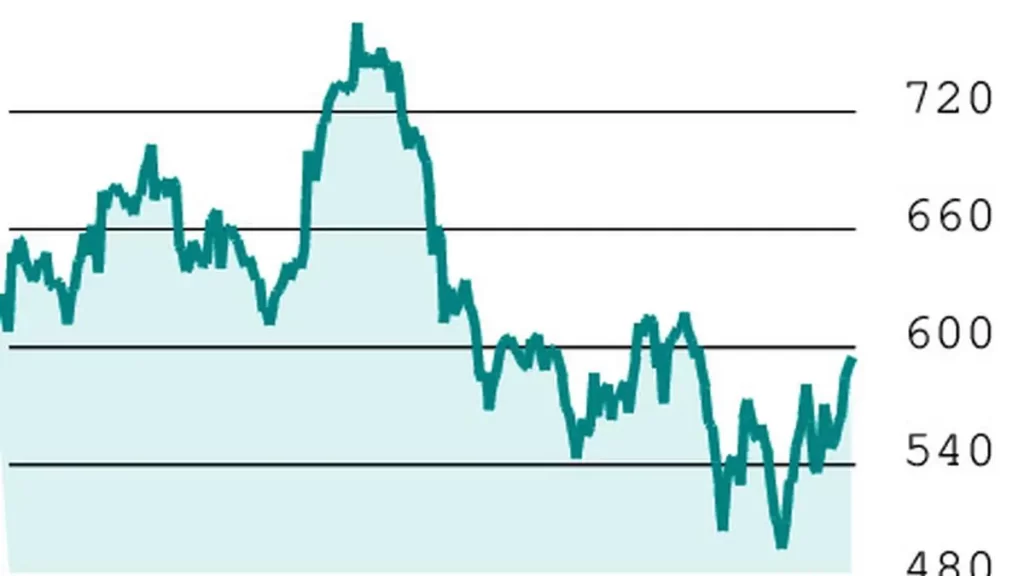

The actions of Au Small Finance Bank (₹ 586.55) are ruling at a crucial level. The short -term perspective is positive as long as it remains above ₹ 529.

The action finds immediate support in ₹ 563. The immediate resistance levels are ₹ 633 and ₹ 735. A closure above the latter will alter the long -term positive perspective. We hope that the stock will move in a narrow range with a positive bias.

Event: Its Board will meet on April 22 to consider the results of the fourth quarter.

F & O Pointers: Au Small Finance Bank witnessed a reinvestment or 23 percent of April to May contracts. Interestingly, Au Small Finance Bank’s AU Futures is in ₹ 581.60 against the May value of ₹ 572.85 and the ₹ 566.55 of June. The setback indicates the turnaround of short positions. Commerce option (May) suggests that the action could move in the range of ₹ 550-600.

Strategy: Consider a bull spread. The stock will be volatile results. Merchants could consider buying 585 calls and simultaneously sell the 600 blows of Au Small Finance Bank (May Series). These options closed with a premium of ₹ 24.95 and ₹ 19.20 respectively, which makes the total jump ₹ 5.75/contract.

As the market lot is 1,000 shares, this would cost the operators ₹ 5,750, which would be the maximum loss. The merchants would suffer the maximum loss, if Au Bank is stuck in or less than ₹ 585 at maturity. On the other hand, a gain or ₹ 9.25 or ₹ 9,250 is possible if Au Bank reaches the ₹ 600.

Follow up: Sail’s actions moved in the expected lines and reach the goal objective.

Note: Recommendations are based on technical analysis and F&P positions. There is a risk of loss in trade.

Posted on April 19, 2025