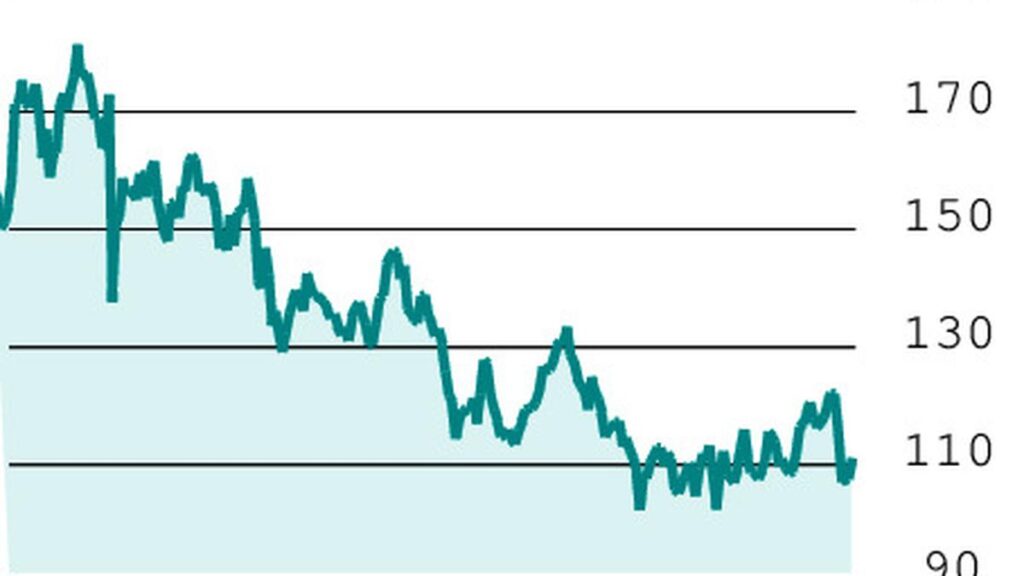

The Sail stock (₹ 108.34) is ruling at Critical Runnure. The short -term trend remained negative and finds immediate support in ₹ 100 and ₹ 84.90. On the other hand, immediate resistance appears in ₹ 118 and ₹ 129.

We hope the stock remains volatile and can try to withdraw. Merchants must take into account that the tariff war between China and the United States will have a great impact on metal stocks, especially steel manufacturers such as candle.

F & O Pointer: Sail April Futures (₹ 108.65) has witnessed a constant decrease of open interest in recent days along with the price of the fall in the price of the shares. From 14.50 million rupees on March 28, OI fell to 12.99 million rupees currently and the price of shares fell from ₹ 115 to ₹ 108. The unrolling of long positions indicates the nervousness of merchants. The options trade indicates that it could move in the range of ₹ 100-120.

Strategy: Buy April 110 Call on Sail that closed to ₹ 3.20. As the market lot is 4,000 shares, this strategy would cost ₹ 12,800. Initial detention can be placed in ₹ 1.80. Change this to ₹ 3 If the price moves to ₹ 3.75. Operators can point to an objective of ₹ 4.25-4.5.

Operators must keep in mind that April has too many vacations and, therefore, the premium will fall due to decomposition. Therefore, it is prudent to reserve profits anyway.

Follow up: As advised, the strategy in Informationys can review the subsequent results, as we expect Wild Swing after that event. Last week, he turned wildly due to the movement of the global market.

Note: Recommendations are based on technical analysis and F&P positions. There is a risk of loss in trade.

Posted on April 12, 2025