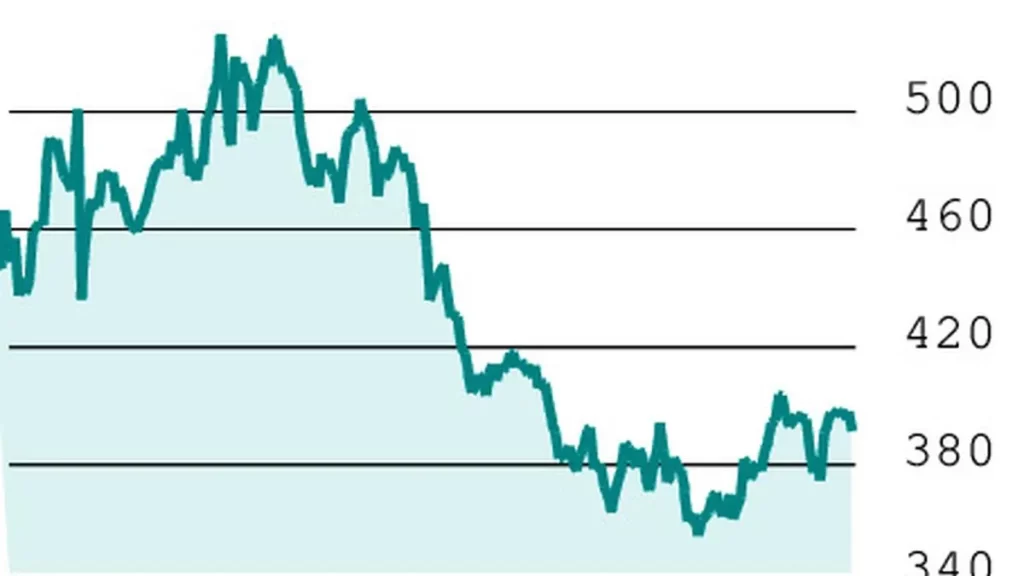

The Indian coal stock (₹ 393.15) is ruling at a crucial level. The immediate support levels are ₹ 369 and ₹ 354. A closure below the letter will change the long -term negative perspective.

On the other hand, the closest resistance is in ₹ 406. A closure above ₹ 467 will change the positive long -term perspective for actions. We hope Coal India moves in a narrow range with a positive bias.

F & O Pointer: Coal India witnessed a reinvestment or 92 percent of the May series since April. The future of May closed to ₹ 394.10 compared to the spot price of ₹ 393.15. This premium signal reinvestment of long positions. The option of options indicates that Coal India will move in the range of ₹ 370-450.

Strategy: Buy 395 calls in Coal India that closed with a premium or ₹ 14 on Friday. As the Indian Coal Market lot is 1,050 shares, this strategy would cost ₹ 14,700. This would be the maximum loss and can happen if the action is stuck in or less than ₹ 395 at maturity.

Gains potentials are huge if the Indian coal stock increases sharply. The equilibrium point is ₹ 409.

Maintain an initial stop loss in ₹ 7. Change it to ₹ 13 If the action opens with a firm note and the premium movements fit ₹ 15. Operators can point to an objective or ₹ 20.

Follow up: Au Small Finance Bank ascended as expected and could have provided profit opportunities.

Note: Recommendations are based on technical analysis and F&P positions. There is a risk of loss in trade.

Posted on April 26, 2025