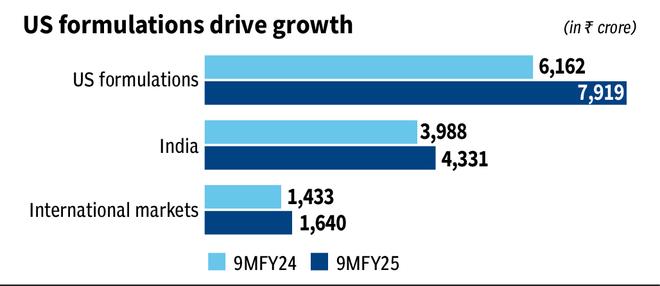

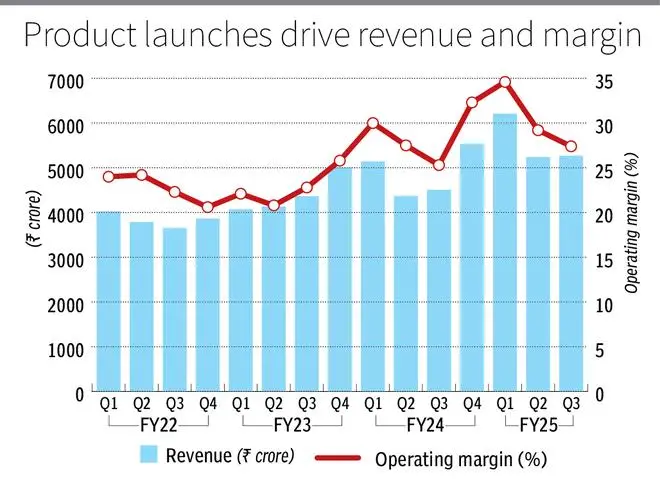

ZYDUS LIFESCIENCES has had a strong 9MFY25 that reports an income and profits growth of 19 percent and 26 percent, respectively, year after year. The US market, which represents half of the income, led with an interannual growth of 30 percent in the period. The action has won 84 percent since our last call of accumulation on March 16, 2023.

The company now faces winds against avoiding a similar level of growth despite a solid pipe. His recent acquisition also needs more clarity to justify the accumulation of value. We now recommend that investors have the shares despite the attractive valuations 18 times for a year of earnings forward.

Winds against growth

The US portfolio was obtained from the contribution of generic Revlimid, Mirabegron and an equally strong base portfolio led by generic Asacol HD. The contribution of these three is expected to decrease next year.

On April 17, Astellas Pharma, innovative of Mirabegron, won a favorable failure in a patent case against generic players Lupin and Zydus. At the time of last year’s launch, the $ 2.4 billion market was shared between the three, which should have delivered sales of around $ 100-130 million per year to Zydus, about 10 percent of its US income. This can stop with the court ruling. Similar in size, Generic Revlimid is also in the last stages of income contribution, and fiscal year 26 will be the last year of high income of this product, since limited competition will rise. Zydus relied on a concentrated portfolio for his base business that included limited competition products. Asacol HD Generic will now face competition. This implies a higher discount and a greater market share.

Innovative portfolio

The strong cash flows of the products have been invested in a strong innovative portfolio by the company with about 8 percent of the revenues in R & D. This should initiate income contributions in the next three years.

The main product is Saroglitazar (already marketed in India), which is located in the phase Iib/III stage of clinical trials in the US. The product is in the study phase after the PBC trial (primary biliary cholangitis). The generated data is expected to be analyzed by CY26-End, Post, which can enter a new medicine application. It is also found in a phase-iib study for steatohepatitis associated with metabolic dysfunction (previously known as NASH). For a similar Gilead molecule (North American Major Pharma Company) -seladelpar for the indication of PBC, the maximum sales estimate is $ 500 million and was acquired by Gilead for $ 4 billion in February 2024. Front capacity and obstacles of head to head before being discounted in the price of shares. Usnoflast is also being studied in the US. In a phase Iib study for the condition of AS.

Zydus Cotx-101 has complete studies and is under a priority review with the US FDA. The product is for the treatment of a strange disease: Menkes. The rare medicine for weakening disease will be a slow increase, if approved, since the patient’s discovery and conversion are expected to be slow.

While these are at the highest end of innovation, Zydus has also accelerated mid -range innovation with the focus of three Sitagliptin products (January for diabetes), which are addressed under 505 (b) (2) via. This route is for established molecules, but with limited changes, which need limited and rewarded clinical trials with an exclusivity period. While the potential must be high, the loss of pending sitagliptin: the base molecule in next year and the slow increase in marketing for slightly different products should temper expectations. Zydus, thought, has a supply groove with the United States government for the three and has included them in the CVS form (the main pharmaceutical benefits chain in the United States), ensuring some visitors. This disaster is also expected to slowly. There are other 505 products (b) (2), property/associate, which complement the portfolio and are expected to be launched in fiscal year 26-27.

In India, Saroglitazar and Desidustat lead the innovative portfolio. Zydus is focusing on India and emerging markets (EM) for biosimilar. A biosimilar is about to be launched in India, two in Mexico and some others are also expected in the medium term that serves segments of specialized oncology and nephrology. A vaccine for typhoid is under review for both India and UNICEF markets, which complements the existing vaccine portfolio. Directed by complex and innovative portfolios, the company has promoted a strong impulse in India and EM in 9MFy25 and you can expect them to continue.

Medtech incursion

On March 11, Zydus announced negotiations to acquire a control participation (85.6 percent) in the surgical amplitude based in France for consideration or € 256 million (₹ 2,500 million rupees), a premium or 80 percent at the previous closing price. This values the company to a business value (EV) or 400 million euros and EV/EBITDA of AROUD 15 times based on the end of the year of June 2024.

The company reported a nominal growth of 6 percent in fiscal year24 (end of June), but a strong ebite margin or 25 percent. With the slow growth and high competition in the Medtech space, which is dominated by some players and Zydus as a recent participant, we believe that the accumulation of value will be an exhibition story. The lack of presence in the United States is positive for acquisition.

Valuations

Zydus has a strong portfolio that is diverting towards the prospects for specialized growth and more sticky than those offered by the genericians. But there are also winds against short -term income. The acquisition will recently be a cantilever until management explains the value-acretion plan. At 18 times for a year, the winds against and the opportunities are in a uniform throat for investors to have the shares.

Posted on April 26, 2025