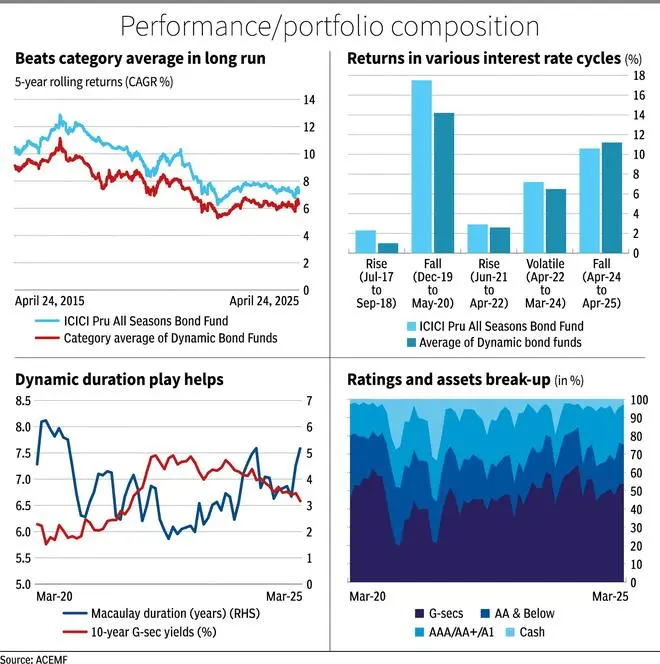

Debt fund investors have enjoyed good yields in the last 18-20 months, especially from longer strategies. In the last year, long -term funds, golden funds with a constant duration of 10 years and dynamic bond funds registered yields or 13 percent, 12 percent and 11 percent respectively.

The RBI maintained a repo rate of 6.5 percent as of February 2023 Onrives as inflation exceeded its goal. As inflation and growth concerns arose, the RBI monetary policy committee (MPC) turned in early 2025, implementing consecutive cuts from 25 base points in February and April, reducing the 6 percent rate. Change of a companion’s neutral posture suggests that speed cuts can be on the horizon.

Market observers point out that after recent demonstrations, the 10-year G-SEC yield in 6.3 percent seems to be the price of expected rates cuts completely, which potentially limits a greater rise for long-term strategies. Consequently, funds with 1-3 years duration that offer attractive transport without an excessive interest rate can represent more balanced opportunities in the current environment.

This makes dynamic bond funds, known for its flexible duration management, are a good addition to the investment portfolio. Its nature for all climate allows yield both in ascending and fall rate scenarios.

The Bond Fund of the ICICI prudential season (IASBF) has constantly overcome within the category in several interest rates cycles.

Static allocation, active duration

The fund demonstrates a static approach in the allocation between governmental values and credit exhibitions. An average of 48 percent of its portfolio has been introduced in government values in the last five years. At the same time, around 45 percent has been invested in corporate debt, with half of that qualified portion of AA or less. This greater emphasis on government values helps in risk mitigation and provides the necessary liquuidity for active duration management.

The background navigates through interest rates cycles through the management of tactical duration. What differentiates this fund is its patented economic model developed in a decade that directs the construction of portfolio based on macroconomic indicators that include fiscal deficit, current account deficit and credit growth. This helps the fund manager to adjust the duration of conservative positions to aggressive alignment with economic conditions.

For example, the duration of market conditions after the market, the model correctly anticipated fees increases, which leads to the fund to reduce the duration to approximately two years, while significantly increases exposure to floating rate bonds. Floating rate bonds can adjust to market conditions efficiently as their periodic interest rates restart to reflect the prevailing rates. This helped the fund to deliver higher or 18 percent yields to the cycle compared to the 14 percent category average.

However, the fund has had a lower performance than the category average in approximately half the half percent in the current decrease cycle, mainly because it maintained a Macaulay duration of about four years. On the contrary, companions with durations of eight years or more, the highest returns.

Taking into account the current opinion of the manager that the 10-year-old G-SEC bonus is theft and factorized in early rate cuts, the background is expected to be shorter.

The fund usually points to a high -level transport portfolio investing in shorter bonds, mainly within the AA qualification segment. Among its peers, it has the highest allocation to the AA and low qualification bonds, a strategy that allows the highest return potential while the risk of acceptance. Around the last five years, it has maintained an average or 23 percent allocation to these bonds. The prominent emitters with AA classification in the portfolio include Tata Projects, Nirma and Vedanta.

The bond fund of all prudential Icici stations has demonstrated a solid long -term history in several interest rates cycles. Their aggressive strategies of duration and credit, however, result in greater return volatility.

During the last decade, the annual yields of the Fund have widely oscillated, from a minimum of 1.2 percent in 2021 to a peak of 19 percent in 2016. An analysis of 5 -year yields in the period of 10 years in the last 10 years reveals that the fund generated an annualized yield of 8 percent, exceeding the average of the category of 6.6 percent.

The fund has a portfolio yield for maturity (YTM) or 7.64 percent as of March 31, 2025, the highest among the companions.

The fund’s expenses ratio for the regular plan is 1.3 percent, slightly above the average category of 1.2 percent, while the direct plan cost ratio is 0.59 percent, higher than the category average or 0.52 percent.

Posted on April 26, 2025