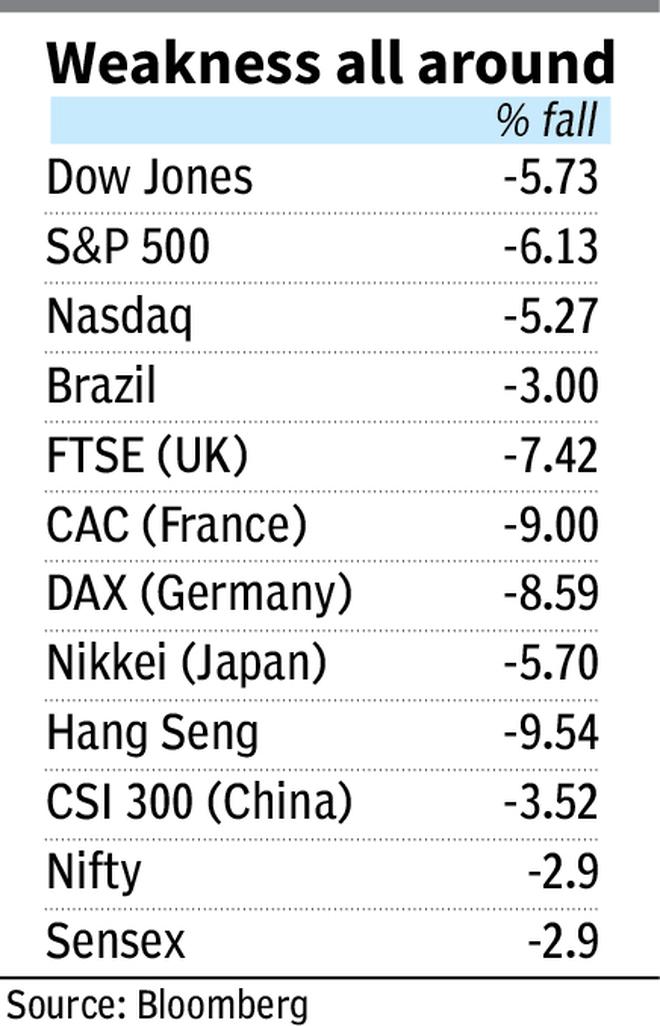

Indian actions have resisted the storm better than global companions this month. In the month to date, the Nifty and the Sesex have slipped 2.9 percent each. In comparison, US indices have been slipped 5.3-5.7 percent, while key European rates fell from 4 to 6 percent. Among the Asian indices, Hang Seng is the main loser, more than 9 percent. Only the indices of Spain, Australia and Japan have been better than India.

President Donald Trump Signed an Executive Order on April 2, Impose a minimum 10 per cent Tariff on All us imports Effective April 5. 90 Days for 90 Days for 90 Days for 90 Days for 90 Days for 90 Days for 90 Days for 90 Days for 90 days for 90 days for 90 days for 90 days for 90 days for 90 days for 90 days. The 10 percent rate remains in force.

Rahul Singh, Cio-Equits, Tata Asset Management, said: “The recent global tariff changes have added uncertainty to markets, but India is better positioned than before. With lower exposure to the US trade. UU. And a strong demand, metals can support Indian partners by reducing contribution costs.

Stock markets increased on Friday with reference indices that published solid profits after the United States’s decision to stop reciprocal tariffs in most countries for 90 days. The BSE Sensex closed to 75,157.26, jumping 1,310.11 points or 1.77 percent, while the NSEFTy 50 NSE rose 429.40 points or 1.92 percent to finish 22,828.55, almost erasing the previous losses of the week.

Metal stocks emerged as the star artists of the day, with the ingenious metal index that increased 4 percent. Hindalco Industries led the Gainers with a jump of 6.70 percent to ₹ 601.80, followed by JSW Steel and Tata Steel, which increased 4.99 percent and 4.95 percent, respectively. Coal India won 4.60 percent, while Jio Financial Services advanced 4.29 percent.

The largest market also participated in the rally, with the ingenious MIDCAP 100 index that increases 1.85 percent to 50,501.50 and the Smallcap 100 index won 2.80 percent. The amplitude of the market was too positive, with 3,115 actions that advanced against 846 decreasing in the EEB, which resulted in an early anticipated relationship or 3.68, the highest since March 5.

All sector rates ended in green, with metal, hard consumption, pharmaceuticals and oil and gas registering substantial profits. The market fear indicator, India Vix, decreased abruptly by 6.17 percent to 20.11, indicating the relaxation of anxiety for investors.

Among the few losers of the day were the Asian paintings, which fell 0.75 percent to ₹ 2,393, Apollo hospitals, 0.53 percent to ₹ 6,798, and TCS, which fell marginally at 0.26 percent to ₹ 3,238.

Despite the strong performance of Friday, the Nifty ended the marginally lower week at 0.34 percent. Foreign portfolio investors (FPI) have remained net sellers in April, with exit output of ₹ 32,122.76 million monthly rupees, according to Shrimant Chouhan, head of equity research at Kotak Securities.

Looking to the future, market participants will closely monitor global developments, partly commercial tensions of Us-China, as well as the current profit season Q4Fy25, which until now has shown mixed results.

“We hope that the index will be consolidated in the range of 23,050-22,250 in the next time truncated. During this consolidation phase, volatility is expected to remain high in the middle of a development related to Tarid and the progress of the profit season of the fourth quarter,” he said in Icetes on IPtesit,

Posted on April 11, 2025