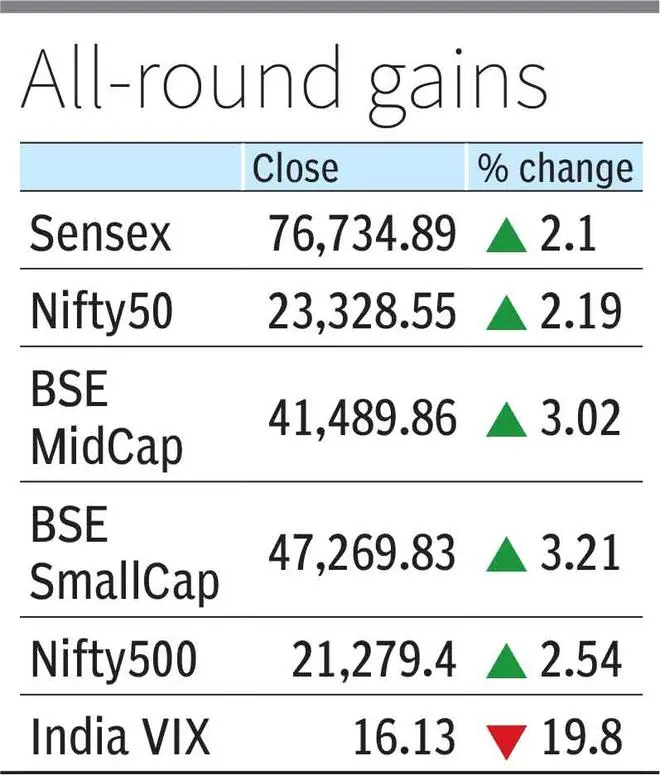

Variable rental markets were abruptly recovered on Tuesday, registering more than 2 percent of profits when investors encouraged the decision of the president of the United States, Donald Trump to exempt smartphones and other electronics of tariffs on Chinese products. The reference point increased 1,577.63 points (2.10 percent) to close to 76,734.89, while the NIFTY rose 500 points (2.19 percent) to establish itself at 23,328.55.

The rally was wide -based with all sectoral indices that are negotiated in positive territory. The ingenious realty index arose the best performance, increasing 5.75 percent, followed by car that gained 3.4 percent and metal that increased by 3 percent. Banking, TI, infrastructure, oil and gas and pharmaceutical sectors also advanced more than 2 percent.

“The manifestation was driven by optimism around the postponement of tariffs and recent exemptions on selected products, which increases the hopes of possible negotiations that could relieve the general impact on global trade,” said Ajit Miskra, research, religious frown.

Market participants pointed out that Trump’s suggestion about possible exemptions for 25 percent motorobiles contributed significantly to manifestation in car actions. “The markets opened strongly higher in the mostly positive global signals after the United States eliminated the smart and other electronic phones of their tariff Stadady “.

Winners and losers

Among the main winners of the NSE, Indusind Bank led the table, increasing 6.67 percent to close to ₹ 735.50. It was followed by Shiram Finance, which increased 5.17 percent to ₹ 671.85, Tata Motors won 4.61 percent to ₹ 622.50, Larsen & Toubro moving 4.59 percent to ₹ 3,259.00, and the axis bank rises 4.35 percent to ₹ 5. in 0.28 percent to close to ₹ 420.35.

The widest markets exceeded the reference rates, with the NIFTY MIDCAP 100 index increasing by 2.92 percent and the NIFTY SMALLCAP 100 index increased by 3.08 percent. The amplitude of the market was too positive with 3,266 advances against 833 decreases in the EEB, while 91 shares reached its maximum of 52 weeks.

Market volatility cooled significantly, and India’s vix fell 19.81 percent to 16.12, indicating a reduced fear among investors. Foreign institutional investors (FII) were net buyers for a sum of ₹ 6,066 million rupees, while national institutional investors (DII) were net sellers of ₹ 1,952 million rupees.

In the Technical Front, Rupak of, Senior technical analyst at LKP Securities, said: “The index has formed a pendant man pattern in the daily table, indicating a possible pause in the current rally. On the other hand, the index closed the emeema of 100, Whet-Whet, Whet, Whoopin, Whise, Whet, Whoopin The 100 -Imemememem -memememememem -mam -Mimavornavornamim Emimaveat Araveat Purorniae, Whit, Whoy.

Similarly, Hardik Matalia, Broking Choice Derivative Analyst, observed: “In the daily table, the ingenious index formed a candle man’s candle, which indicates a possible ruin in the upward trend and the possibility of the posivility of failure levels.”

Shrikant Chouhan, main research in Kotak Securities, suggested that, although the feeling of the optimistic remae market could arise at higher levels. “For merchants, 23400/76900 and 23500/77300 would act as key resistance areas, while 23200-23135/76400-76100 could serve as crucial support areas.”

Earnings

The Indian rupee won against the dollar, appreciating at 0.35 rupees to close at 85.75. “The Rupia traded positively with profits from ₹ 0.35 to 85.75, marking its second consecutive session or strength after a strong recovery of the recent minimum of 86.80 seen on April 9, 2025,” said Jateen Trivedi in Secretnce – Commodes. “The rebound has been largely driven by a strong decrease in the index of dollars in the last sessions, which has provided substantial support to emerging market currencies, including rupee.”

In basic products, it remained firm as a continuous weakness in the dollar index supported safe demand. “Gold remained firm within a positive range as a weakness in the dollar index and persistent uncertainty related to the sustained rate of safe demand and long positions,” Triveedi said. “In Comex, Gold maintained his land above the key support in $ 3200, with a visible resistance that emerged about $ 3255. At the national level, McX Gold quoted around ₹ 93,350, since the profits were appreciated.”

Nagaraj Shetti, a senior technical research analyst at HDFC Securities, highlighted the positive technical indicators for the NIFTY. “Nifty is now placed on the edge of the rising rupture of the 200 -day EMA obstacle around 23360 levels. The huge opening holes without filling of the latest sessions indicate bullish fugitives, which are normally formed in the middle of a trend.”

Looking towards the future, analysts expect the market to maintain their positive bias. “In the future, we hope that the index will maintain a positive bias and go to 23,560 in the next week of the sessions, being the maximum of the current month,” Bajaj Broking Research said. “Volatility is expected to remain high in the midst of development related to the rate and progress of the fourth trimester profit season.”

More like this

Posted on April 15, 2025