Much of the economic growth in India, especially the duration of the period after Covid, has been promoted by large investments made in the infrastructure space, largely by the government and a select of the intensive capex segments of them.

Energy, railroads, telecommunications, civil aviation, ports, shipments and river roads, road transport and roads have seen a capex growth of 37.1-88.1 percent composed annually around FY20-FY24.

For fiscal year 26, the government has budgeted ₹ 11.21 billion to spend on capital expenses, which represents growth or 10.1 percent on the estimated jump in fiscal year 2015.

Given this context, as an investment issue, infrastructure remains attractive to an emerging economy as India that hopes to achieve a 6-7 percent growth for the prevailed future.

Without a doubt, several funds with the infrastructure issue have existed for more than a decade and many have a reasonably healthy history.

In this sense, Motilal Oswal has implemented a new infrastructure fund that will be open for subscription until May 7.

Keep reading to obtain a perspective on the new sacrifice of funds and also the history of the existing fund to receive an informed call.

What is the new background

The Oswal Motilal Infrastructure Fund seeks to benefit from several underlying themes that would lead to rapid expansion in many subsegments.

Then, China plus one, in India, urbanization, financing, consumer technology and digital infrastructure, the health ecosystem, telecommunications penetration could be potential growth promoters in the coming years.

The fund has a broader definition of infrastructure to include several segments: motorobiles and components, capital goods, construction and materials, medical attention, oil, gas and consumable fuels, energy, real estate and telecommunications. This broader reach provides more opportunities for the fund to invest.

India will spend 22.1 percent of the total amount budgeted in capital spending (the highest proportion over the years) in fiscal year 2016.

In fact, Capex in Defense, Railroads, Housing and Roads has increased from 3 times to 17 times from the Fiscal Year 2011 to fiscal year 2015.

The background will use its QGLP frame to select actions. Quality criteria (roe, rubbing), growth, longevity and price (PE, PEG and DCF) would be used to expand the best set of actions in the infrastructure issue.

Should you invest?

As mentioned above, the infrastructure has a long history. Since the approach for little in power, capital goods about 15 years ago, these funds have diversified more with many segments added to the issue of infrastructure.

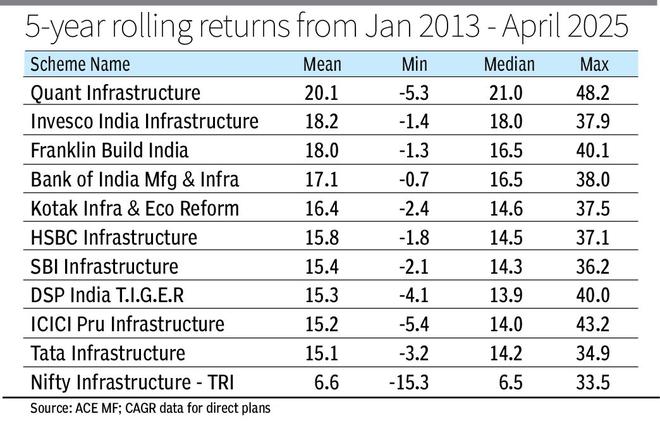

In a basic yield of five years from January 2013 to April 2025, the 18 active funds on the subject have comfortably overcome the ingenious Tri infrastructure.

The main 10 in terms of average yields during the period mentioned above in a basic 5 -year rolling are given in the table.

As an issue, it is important to keep in mind that infrastructure funds can deliver volatile yields. From the table, it is clear that around the bearing periods of five years, there may be periods of negative yields of the funds.

However, about long periods of possession of 7-10 years or more, these investments have been gratifying.

Prudential ICICI infrastructure, Investco India Infrastructure, Boi Manufacturing and Infrastructure and Franklin Build India are funds that have a long history of offering robust yields.

These funds must be the preferred options for investors seeking to bet on the issue of infrastructure.

As a fund house, Motilal Oswal has many schemes that have delivered well in capital categories. But since the issue of infrastructure is risky, investors must observe the ability of the new scheme to juggle with the various segments within the subject.

As investors already have proven funds that track the issue, they must attend if they need any additional exhibition to this scheme.

However, investors with a high -risk appetite can consider small SIP in the scheme if they can remain in the long term.

Posted on April 26, 2025