The Vietnam government is among the many who have rushed to negotiate commercial concessions after the announcement of the president of the United States, Donald Trump, or a 90 -day pause on the reciprocal rates imposed on them, in addition to a base rate walk. There is no way that the country, like many others, can absorb the 46 percent increase in impositions and maintain its current growth and development trajectory.

However, there is a difference. Vietnam is, together with China, one of the two Asian countries that made the transition from a largely growth route directed by the State and in the center of the coordination with a minimum dependence of the western markets, to one that is friendly with the market and oriented to export. Like China, it also managed to guarantee rapid upward growth or 6.5 percent per year for almost four decades since it was launched in reforms in 1986.

Crucial for this success in both countries has been a rapid increase in exports made to Western markets. The results have been a significant increase in the entry of per capita poverty and the huge reductions.

However, while China, after having followed a similar trajectory, chose to face the United States and retaliate with tariffs in imports from that country, Vietnam seems anxious to avoid any confrontation. In fact, he has rushed to begin negotiations and sacrifice any concession that can place the Trump administration and stop the rates imposed on their exports to the United States.

A longer history of central planning, an early diversification in manufacturing even before the reform, the technological capacities that provided the system and the benefit of a large internal market because or its geographical size and large population.

On the contrary, Vietnam’s relative weakness could be explained by the nature of its development trajectory, the limited nature of economic diversification and an excess of offspring of exports to some markets, especially the US market.

Export increase

The role of exports in the economic growth of Vietnam is obvious in the increase in the proportion of exports of goods to GDP, only 3 percent in 1986 to 60 decades two decades later in 2006. While that proportion was around 90 % percent percent percent percent percent percent percent percent percent percent percent percent percent percent percent percent percent percent percent percent percent percent percent percent of one hundred percent by one hundred percent by one hundred percent by one hundred percent by one hundred percent by one hundred percent percent percent percent. Cent percent percent in 2023.

That reflects the enormous dependence of the country of exports. A redemptive feature has been the nature of these exports, with the proportion of manufacturing in the total increase of around 71 percent in 2000 to 90 percent in 2020. Vietnam has been seen outside the dependence on primary products of products.

However, these figures added hide some disturbing trends. To begin, despite the many years of commitment and success of the export market, Vietnam exports are characterized by a high degree of concentration by destination.

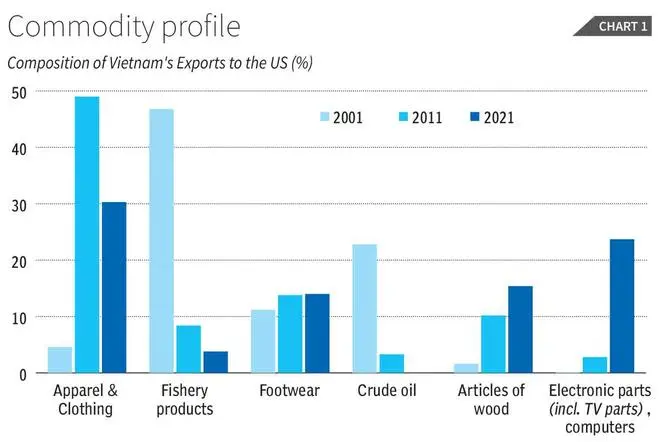

Two countries, the United States (28 percent) and China (20 percent) represented up to half of the country’s exports, only in 2023. Within exports to the United States, which threatens punitive tariffs, the composition of basic products 1 reflects).

In 2001, exports to the US were dominated by fishing products (46.8 percent), crude oil (22.8 percent) and footwear (11.2 percent), which together represented more than 7 percent of exports to that country. That is, primary products and traditional manufacturers dominated. Interestingly, clothing and clothing represented less than 5 percent of exports that year.

For 2011, exports of clothing and clothing came to represent 49 percent of the total and footwear for another 13.8 percent. Together with wood articles (10.2 percent), this set of three basic products groups represented 73 percent of exports.

Meanwhile, the proportion of fishing products fell to 8.4 percent. Despite diversification, the export concentration in terms of basic products continued. This was the case in 2021 too, when electronic pieces and computers represented 24 percent of exports, with clothing, fishing and wood items together representing another 60 percent.

The diversification was administered by the battery by the persistent concentration, in terms of exports to the US. UU. These are exports that Vietnam will have to protect from the wreaked ravages of Trump’s tariffs.

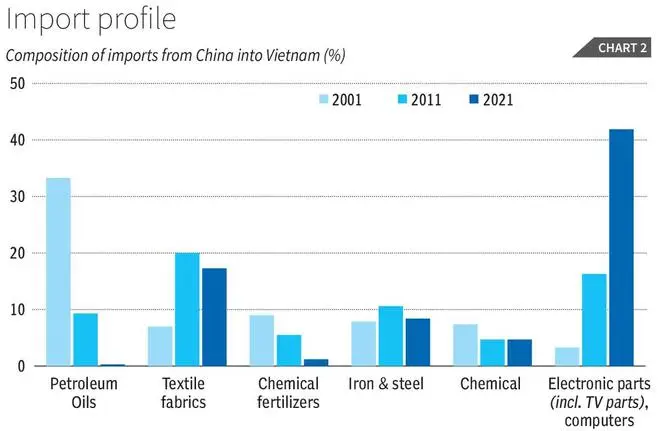

But this is not the only group cause. The other problem is that, although China is the second most important export market for Vietnam (20 percent in 2023), it is also the main source of imports. China represented 22 percent of the imports followed by South Korea (8.75 percent) in a distant second place. The remarkable characteristic is that thesis imports, as well as those of other places, were crucial supplies in export production.

This comes from the composition of imports (Graph 2). In 2001, oil oils represented a third of imports to Vietnam from China. It is likely to be re -exported with limited processing.

In 2011, together with the increase in clothing exports, imports of textile fabrics accounted for 20 percent of China imports, and that figure remained in 17 percent significant in 2021 as well.

About these two decades, the proportion of electronic pieces and computers in the total imports of China increased from 3.3 percent (2001), to 16.3 percent (2011) to 41.9 percent in 2021. The success of Vietnam’s exports was based on its export Ascapforma that forages and serves the imports of ascapform of intermediates (and capital goods and technology) of the general.

Commercial balance

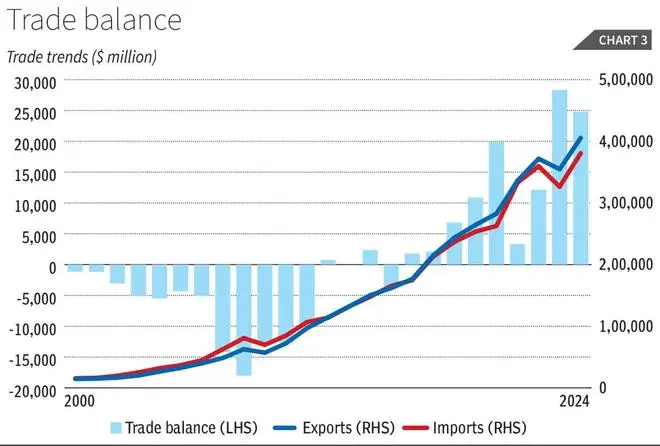

One consequence was that Vietnam’s exports and imports moved together, and export success did not lead to a positive commercial balance until 2013, and the commercial surplus alike after that is small (Graph 3).

Serving as an export platform for finished products based significantly on imported intermediates and capital goods for growth implies that maintaining a high level of exports is crucial, to ensure that the total value (if not per unit) or the domestic added value is large. Given the importance of the US market for Vietnamese exhibitors, this would mean that the volume of exports to that country from Vietnam must remain high.

This explains Vietnam’s desire to reach an agreement with the Trump administration. But the problem remains what Vietnam has to sacrifice to placate the United States. Tariff reduction cannot be a solution.

As part of its strategy that Vietnam oriented to export, the export -oriented strategy (especially after the WTO membership) has already reduced the substantial rate. The middle tariffs weighted in imports to Vietnam have fallen from a maximum level or 19.2 percent in 1999 to a minimum of 2.07 percent in 2022, with the corresponding figures for manufacturers of 16.6 percent (2001) and 0.8 percent (2022), and for the forest for primary. (2022). That is a small room for a greater reduction (Graph 4).

Therefore, if it is likely that negotiation works, Vietnam would have to offer great concessions in the areas of services, including financial services, in which the United States looks as competitive. But that would result in the entry of foreign banking and financial companies and financial interest and capital entries that can significantly increase fragility. Excessive export dependence clearly has its costs.

Posted on April 14, 2025