If all tertiary sectors in an economy, logistics is one of the most significant. With the market share of the actors organized only in unique digits, the formalization of the economy was expected together with the retail electronic commerce space always so lucrative and growing in India stimulated the demand for integrated logistics of third parties (3PL). 3PL players are those who manage the management of their clients’ supply chain, including logistics, inventory management, storage and compliance with the order.

And Delhiver, the prominent player of India in this industry, was at the Recent Care Center after signing a definitive agreement to acquire a control participation (99.4 percent) in ECOM Express.

The history of Ecom Express

ECOM Express is an electronic logistics player B2C pure game focused on express delivery, a niche within 3PL. In 2012, the company even prepared for an OPI and presented its DRHP in August 2024, with the aim of raising ₹ 2.6 billion rupees.

The five main clients of the company that included people like Meesho, Amazon and Nykaa, among others, contributed 75 percent of the revenue of fiscal year 2000. Moreover, the main group of clients (not revealed, but widely cited as Mesho) contributed an amazing 52 percent, which is a clear case of customer concentration risk.

While such a high customer concentration is a clear red flag, read together with the period of association with the client and the personalized offers presented, the risk can sometimes be diluted. But in this case, the risk took shape and made a dent.

The phenomenon of captive logistics

Mesho and Amazon, the two important ECOM clients, began increasingly insurcation logistics operations in India, the phenomenon is called ‘captive logistics’. Mesho, through its Valmo internal logistics platform, began adding logistics partners directly since February 2024, thus reducing the dependence of third -party logistics. Amazon India, on the other hand, launched Amazon Shipping and Amazon Freight in December 2024, which is while driving their own logistics needs, also offers services to third -party companies.

As per redeer analysis FOUND IN ECOM’S DRHP, WITHIN B2C E-COMMERCE SHIPMENTS, WHILE THE LAST-MILE SHIPMENT VOLUMES ROS Before in Fy22, Before in Fy22, Before in Fy22, Before in Fy22, Before in Fy22, before in fiscal year 22, before in the fiscal year22, before in fiscal year 22, before in fiscal year 22, resurfaced in the captive logistics of the 2014 fiscal year, corroborating with the case of Mesho and Amazon India.

A deceleration in business volumes, after healthy 17.5 percent of Cag Fy22-24 growth, meant that ECOM Express revenues remained at ₹ 1,912 million rupees for 9m Fy25 against ₹ 2,609 million rupees for FY24, Down). The net loss, also, after improving ₹ 249 million rupees in the fiscal year24 of ₹ 360 million rupees in fiscal year 2013, deteriorated at 9 million from 2009 to ₹ 398 million rupees.

Delhivery’s profit?

From a maximum valuation of around ₹ 7,000 million rupees in July 2024, ECOM Express is now acquired by Delhivery for ₹ 1,407 million rupees (0.54 times the income of ECOM FY24), 80 percent in just nine months.

The important question now: how do you get Delhivery from this acquisition?

As was the case with ECOM Express, the growth of the volume of the forms of the Express delivery segment has slowed down 9 m fy25 only 1.8 percent, after a CAG growth of 36.8 percent during the FY21-24. With this acquisition, Delhivering has bought its closest competitor in the segment and can consolidate the market share through the construction scale with the existing infrastructure of both entities.

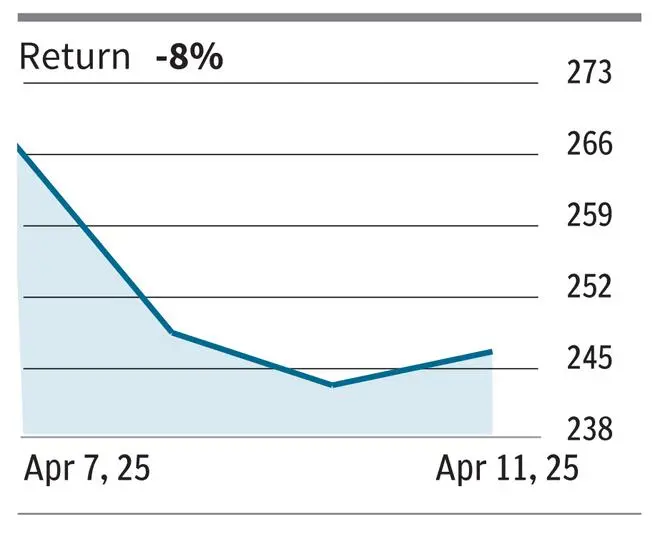

Delhiver closed the negotiation on Friday to ₹ 246.85 per share, throwing 8 percent of the week. But with almost 100 percent overlap or customer between the two entities, integration is not expected to be complicated. However, investors could be concerned about the growing exposure of exposure to a segment that faces challenges. Although the captive logistics phenomenon, a wind against the entire industry, will affect Delhiver’s volumes, the company is relatively diversified, with a revenue contribution from the reduced express delivery segment of 69 percent in the 2011 fiscal year to 62.

Being the biggest player in the industry for a good margin, his comfortable relationship of net to capital or 0.01 (from Q2 Fy25) and the company turning for the first time in 9 m fy25, are green sprouts.

The third -party logistics space could see more action if market conditions remain difficult. But from now on, this is the second sale of relief in 30 months and one of the greatest acquisitions that the industry has seen.

Posted on April 12, 2025