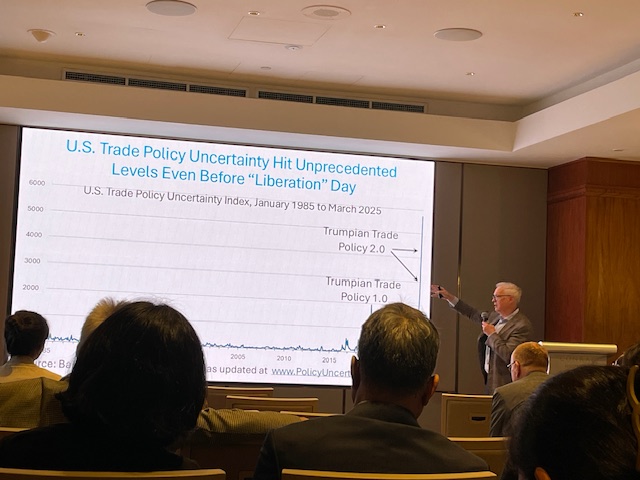

I was at a conference, two, two, in Singapore: the annual conference of the Asian office for finance and economic research, and the Asian monetary policy forum. In the first, I attended a talk by Steven Davis (Hoover), in “measuring the uncertainty of politics, evaluating its conflicts.” A slide summed up my feelings about these times …

The discussion really focused on new research, with respect to jumps in equity prices and its determinants.

In the Asian monetary policy forum, Adam Posen (Peterson Iie) began the presentations of the day, noting that the fragmentation in blocks would end up dissipating the benefits we enjoy following the fall of the Soviet Empire.

Pierre Olivier Gourinchas (IMF Research) provided information on … geopolitical fragmentation of the global economy. This takes the divergence between commercial and financial networks.

I apologize for poor photography (well, I signed up for a career in economics …).

All procedures were fascinating, including the document commissioned by Helene Rey and Vania Stavrakeva (both lb), entitled “Interpretation of turbulent episodes in international finance”. Olivier Jeanne (JHU) and I reached the discussion. The document of the document is good, but I think I can share a graph that I thought partularly interesting.

The value of the cross -border holdings of shares now exceeds that of the links (or all types). Therefore, when thinking about the determinants of the exchange rates, I find it less plausible to trust only on the yields of the bonds as key factors.

Econbrowser recently published a post titled “Photos from a Conference,” where Menzie Chinn shared insights and images from two significant economic conferences held in Singapore: the Asian Bureau for Finance and Economic Research (ABFER) annual conference and the Asian Monetary Policy Forum (AMPF).

At the ABFER conference, Steven Davis from the Hoover Institution presented on “Measuring Policy Uncertainty, Assessing its Consequences,” highlighting the impact of policy uncertainty on equity markets. The AMPF featured Adam Posen of the Peterson Institute for International Economics discussing the fragmentation of global economic blocs, and Pierre-Olivier Gourinchas from the IMF Research Department examining the divergence between trade and financial networks due to geopolitical shifts.

Additionally, a commissioned paper by Helene Rey and Vania Stavrakeva from the London Business School, titled “Interpreting Turbulent Episodes in International Finance,” was discussed. The paper, though embargoed, included a notable graph illustrating that cross-border equity holdings now surpass bond holdings, suggesting a need to reconsider traditional exchange rate models that focus solely on bond yields.