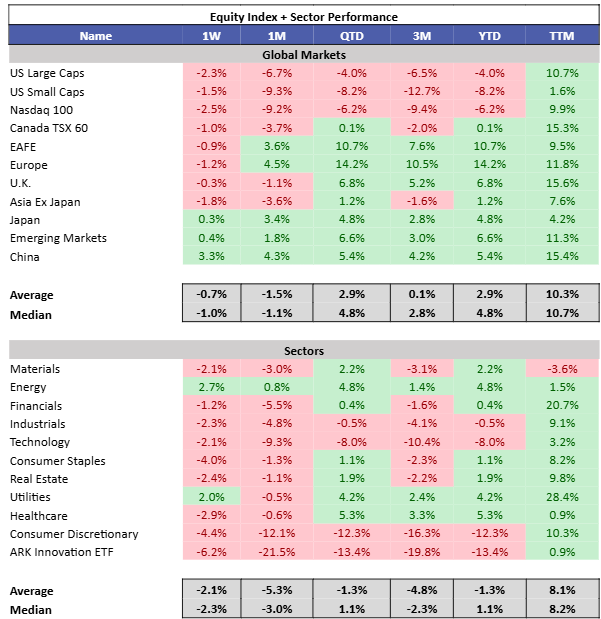

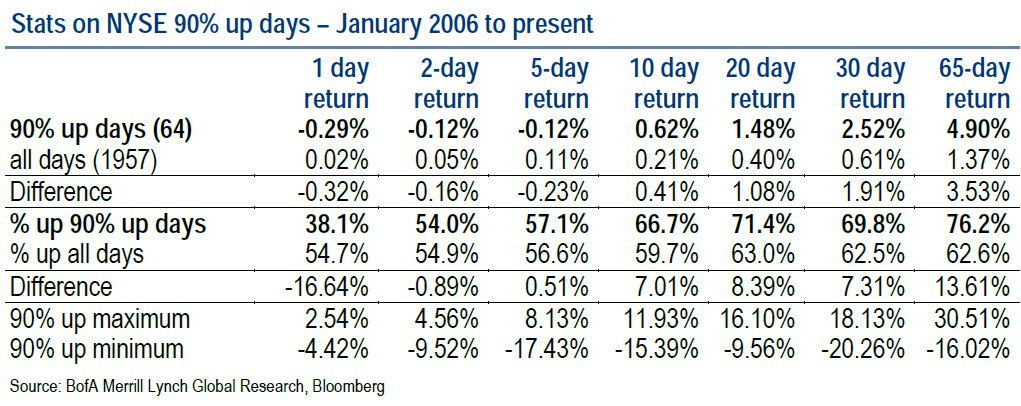

The S&P 500 surged 2.1% on Friday, its largest gain since the post-election rally, following another week of tariff threats. Despite Friday’s gains, the S&P 500 closed its fourth consecutive week lower, the longest losing streak since August. Conflict is escalating in the Middle East, more he US are striking Houthis in Yemen in an effort to enable ships to use the Suez. Energy led US sectors, while consumer stocks lagged. China was the best performing region.

Fixed income yields were relatively flat this week. Gold surpassed $3,000 for the first time. Crypto remained weak, with Ethereum underperforming significantly this year.

Treasury Secretary Scott Bessent was on NBC Sunday morning (Link to full video).

Bessent emphasized that market corrections are healthy and the previous fiscal trajectory was unsustainable. We will need to go through a transition period for the economy as stimulus is reduced. Bessent underscored that the American Dream encompasses more than access to inexpensive goods; it includes aspirations like homeownership and achieving greater prosperity than previous generations. The Secretary discussed the administration’s use of tariffs as a strategic tool to encourage other countries to lower their tariffs, aiming for more equitable trade practices. He also mentioned efforts to reduce energy prices as part of the broader strategy to moderate inflation and enhance economic stability.

His sensible points were undermined by their tariff policies. They are pulling all levers to reduce inflation. His warning of economic turbulence makes me worried about overvalued US equities.

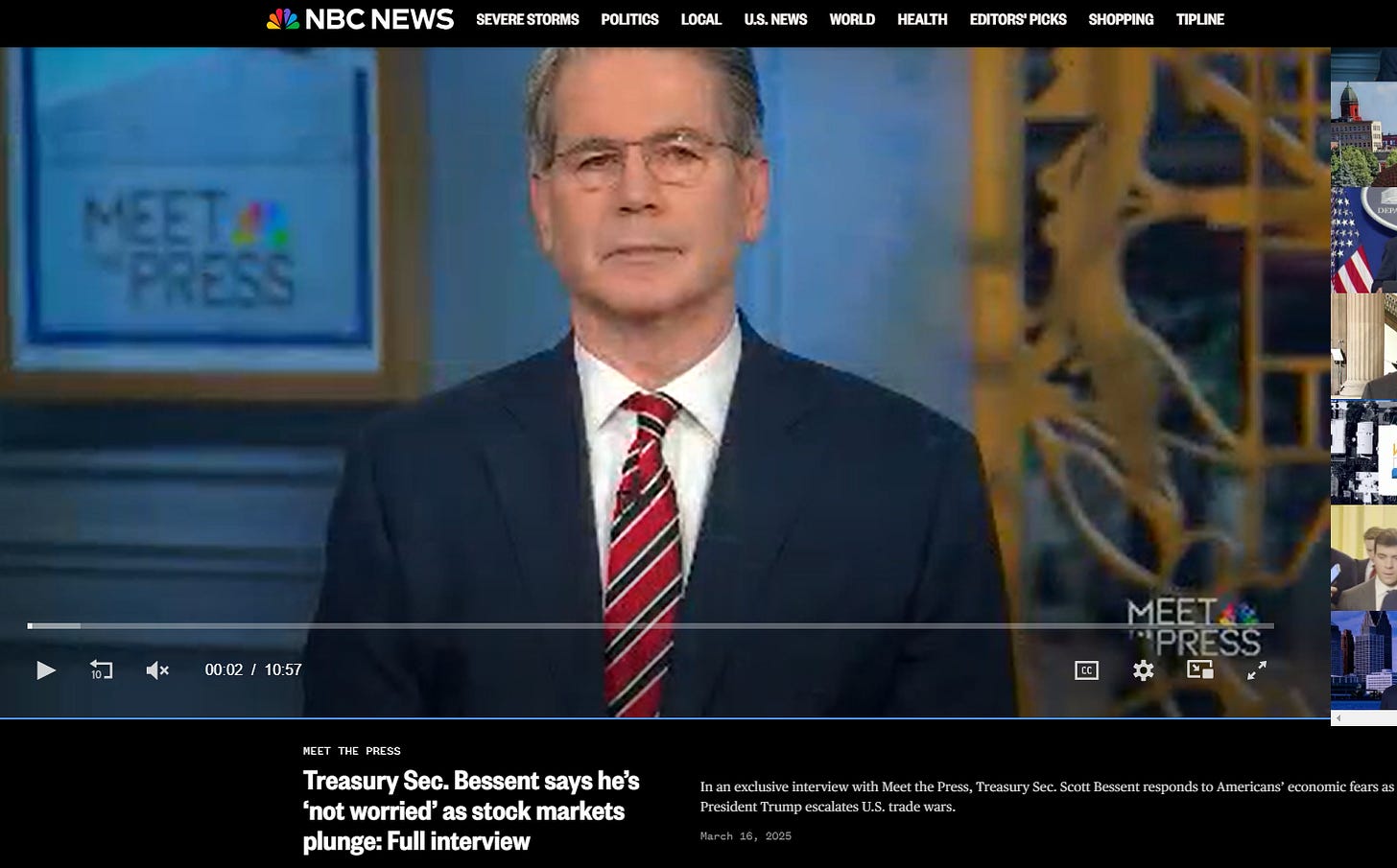

Friday was a 91% up day. This isn’t necessarily a bottom, but historically the worst is over, and short- to mid-term returns have exceeded average. However, strategists remain quite cautious (@TheShortBear).

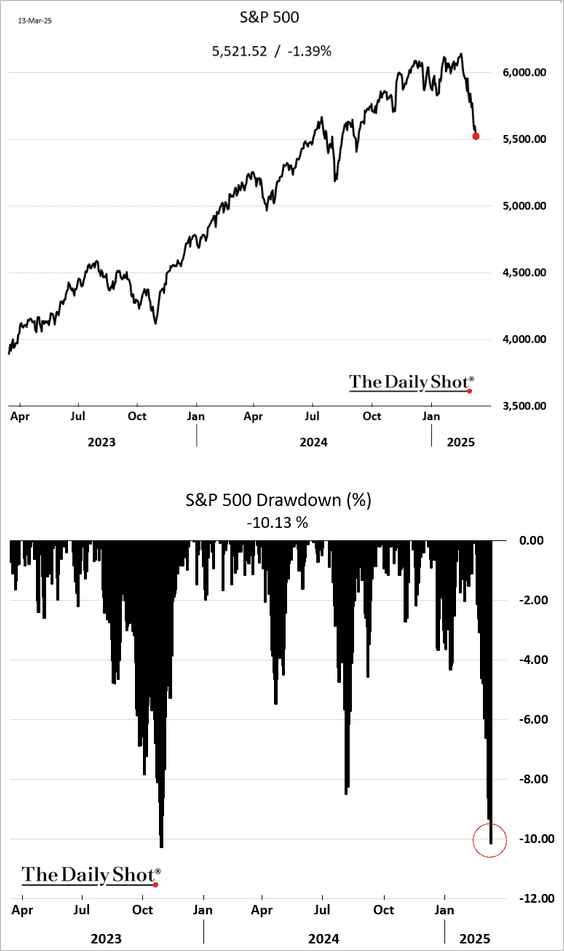

This has been one of the worst drawdowns for the S&P 500 in the past 2 years (The Daily Shot).

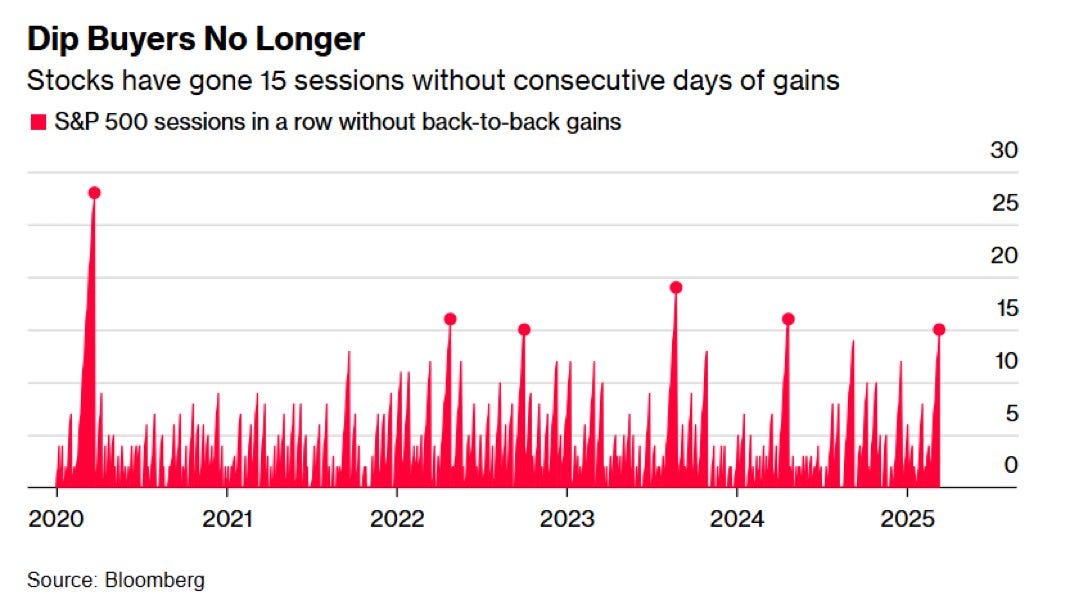

Dip buyers have been burned, we’ve now gone 15 sessions without back to back gains (@TheShortBear).

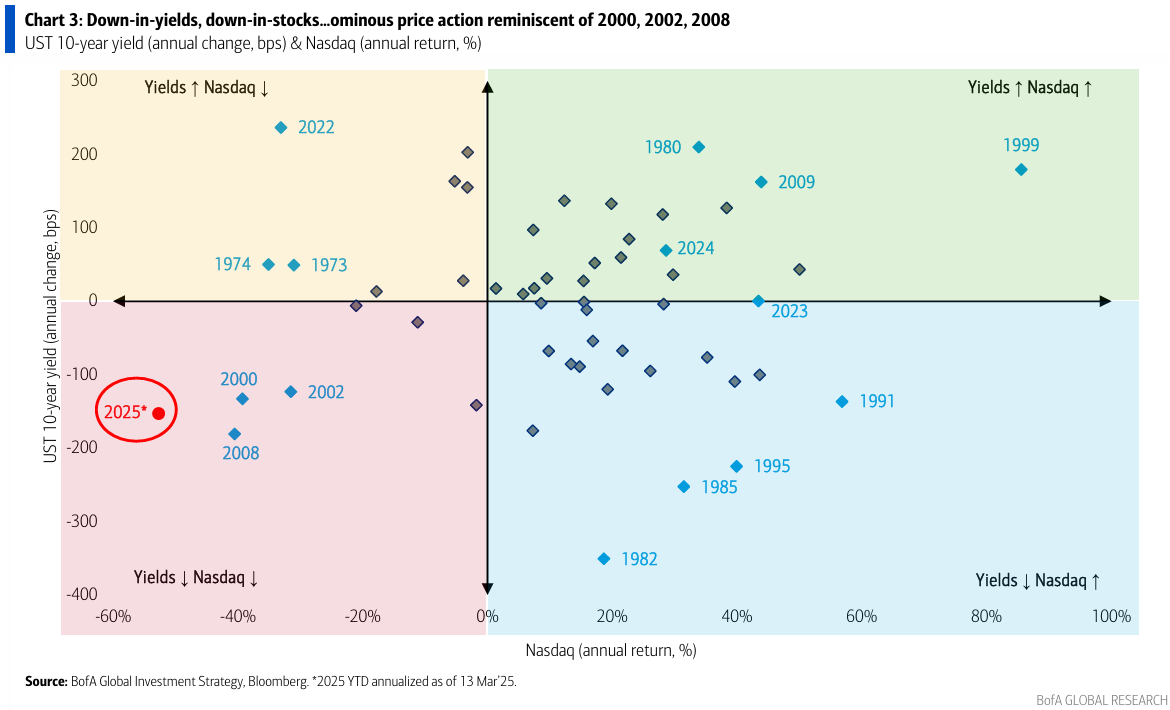

YTD it has been a rare combination of yields and Nasdaq down. Previous instances of this combination have coincided with periods of extreme market weakness (BofA).

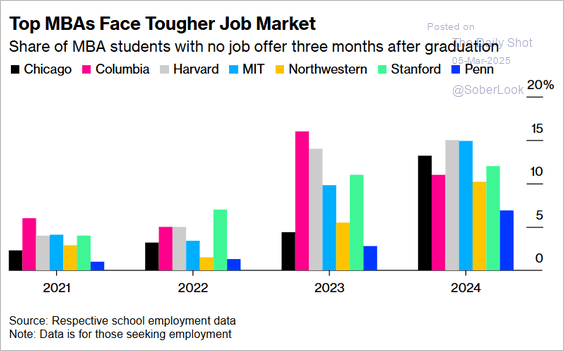

The economy is already on weak footing. MBA grads are struggling to find jobs. Companies slow hiring first, the next stage is layoffs (The Daily Shot).

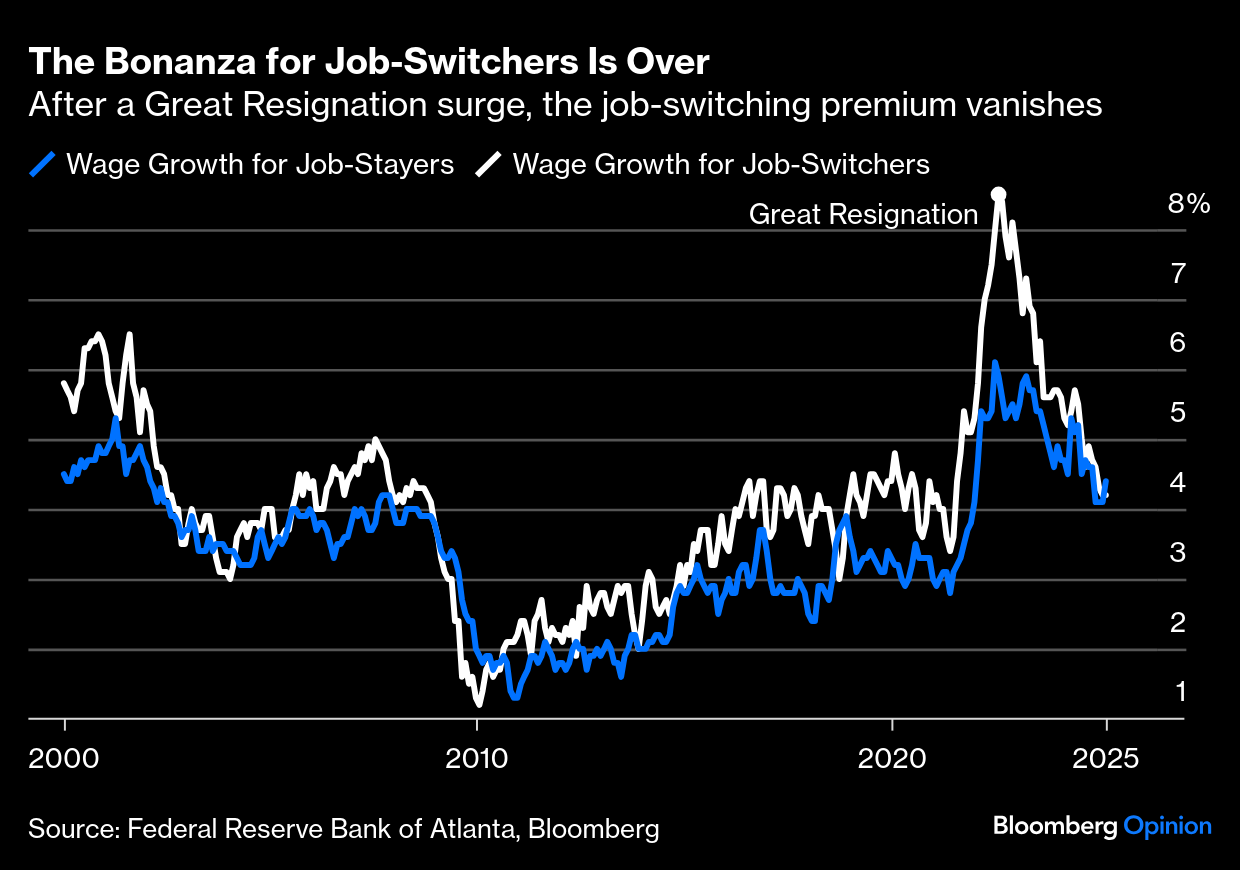

Job switching no longer guarantees large pay increases, signaling a cooling labor market (John Authers).

Lower skilled worker wages are slowing faster than high skilled wages (John Authers).

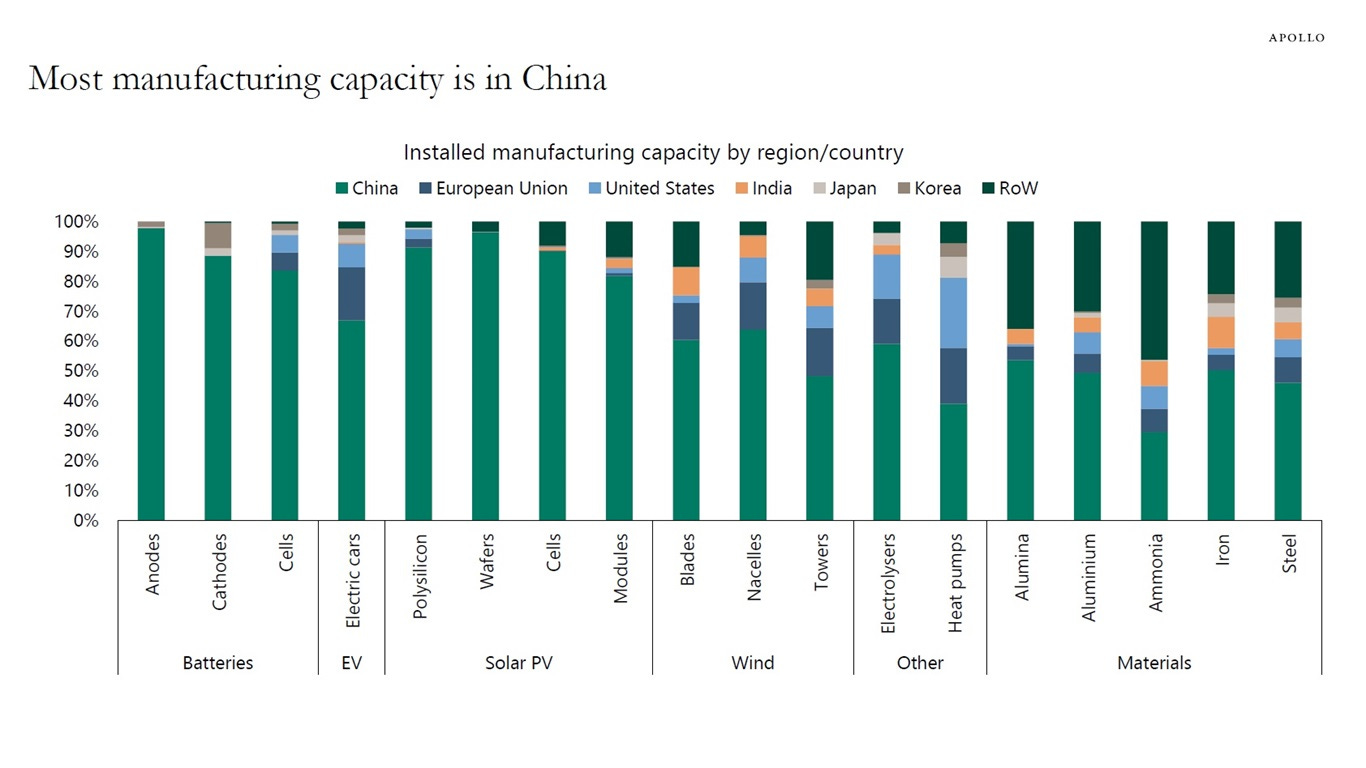

Trump doesn’t like this chart and rightfully so. The problem is, it took decades to build the industrial capacity and develop the skills necessary to dominate manufacturing, it will take decades to reverse… But you need to start somewhere I guess (Apollo).

This is Tim Cook talking about manufacturing in China. Apple doesn’t manufacture in China because of cheap labour, it’s because of skilled labour and capabilities (@balajis).

This excerpt from Palmer Luckey caught my attention on China (Pod).

It is interesting to think about the Apple one in particular. Yeah. Like Tim Cook, I have nothing against the guy personally, but like if I were him, I would feel a little humiliated that I can’t say anything about China, despite supposedly on paper being one of the most powerful men in the world.

Like he speaks out against climate change and he speaks out in favor of diversity and he puts all this money into like ads for mother earth and he, Benny, any tweets about how we all need to respect the rights of black people in America. And we need to solve these blonde force problems. So he’s politically engaged.

Imagine what would happen if he said something like, I believe concentration camps are bad. Like China, on account of the Uyghur Muslim issue, would immediately lock them out of the country. Like he can’t say that. Isn’t that crazy?

Like the most powerful executive in the country running our most valuable company, on account of the whims of a foreign ruler, can’t say things like human rights are good, concentration camps are bad. I think you probably shouldn’t lock people up for their religion. Like he can only comment on our domestic issues because here our government says you’re allowed to say whatever you want about anything.

And if I were him, I’d feel a little humiliated about that. I’d be like, I’m not the big boss, man. I’m not actually powerful. I’m actually just the stooge of the country that makes the thing that I sell. Because they can’t do it. If he did this, imagine what would happen if Xi locked Apple out of China.

$2 trillion in market cap, gone just like that. Almost everything they make is made in China, made with Chinese parts. That would be the end of Apple. The most valuable company in American history exists day to day at the whims of the dictator that runs China.

Isn’t that an insane situation? Could you imagine if that had happened during the Cold War? Imagine if the Kremlin could have just put out a single legal document that would have destroyed… What was the biggest company during the Cold War in America? What would it have been?