That is the title of Wisconsin Policy Forum Focus #9 released earlier this week.

This is what Wisconsin matters in the path of goods:

This is what Wisconsin Exports (From the Wisconsin Policy Forum, letter #6, 2025):

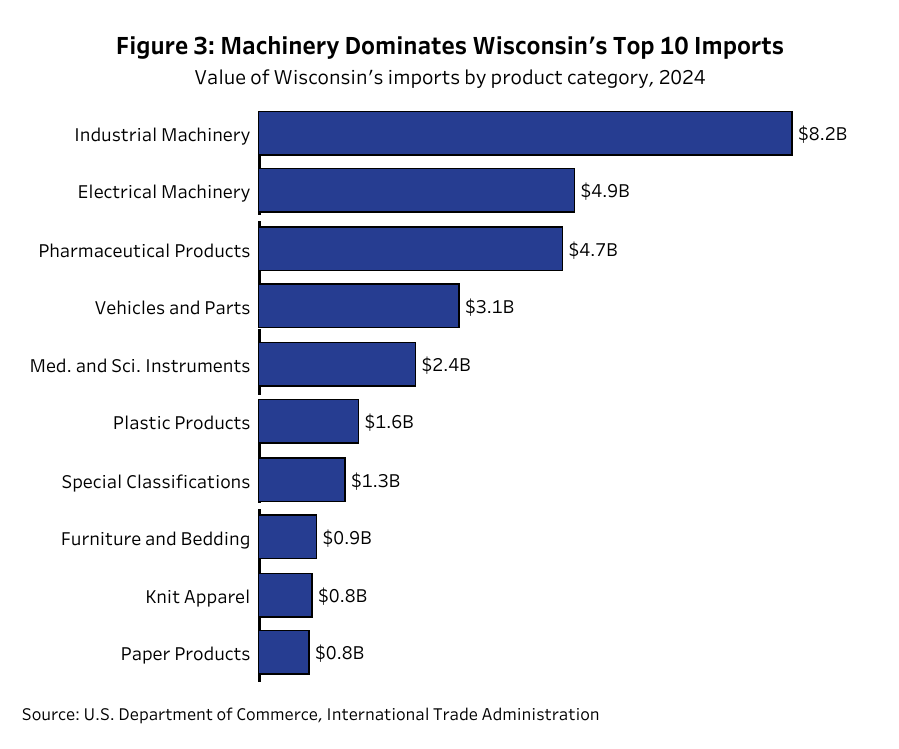

Note that industrial machinery and electrical machinery are the two main categories both in imports and export; That is intraindustrial trade.

What these two graphics do not tell is what participation of exports are counted by imported entries. I do not have this information at the state level of Wisconsin, but here there are estimates nationwide. I have surrounded the corresponding categories in red, in the figure below.

Fountain: Slip, “foreign added value in US exports”, Apollo, May 1, 2025.

Why is this important for Wisconsin? Assuming that thesis relationships are representative of Wisconsin, this means that tariffs in imports to the US. UU. They result in a negative effective protection rate for exports.

Consider an exported tool machine, which was originally sold for $ 100,000 (low trade). If a rate or 10% is applied to imported tickets, or total value or $ 40,000. The effective protection rate is -6.7% (= ((100,000-44000)/60000))-1). = 0.067.

Going to reality, if the imported components represent around 12.5%, and a 30% tariff is applied to tickets (let’s say they are Chinese). Then the effective protection rate is -4.1%…

Here are Wisconsin imports until March:

Figure 1: WISCONSIN GOODS IMPORTS IN MILLIONS (BLUE), IN MILLIONS 2000 (TAN), both seasonally adjusted. Series adjusted by the author using X-13 in records. Deflation using the price index of all comforts throughout the country. The maximum recession dates defined by NBER are shaded gray. Source: Bea, Bls, Nber and the author’s calculations.