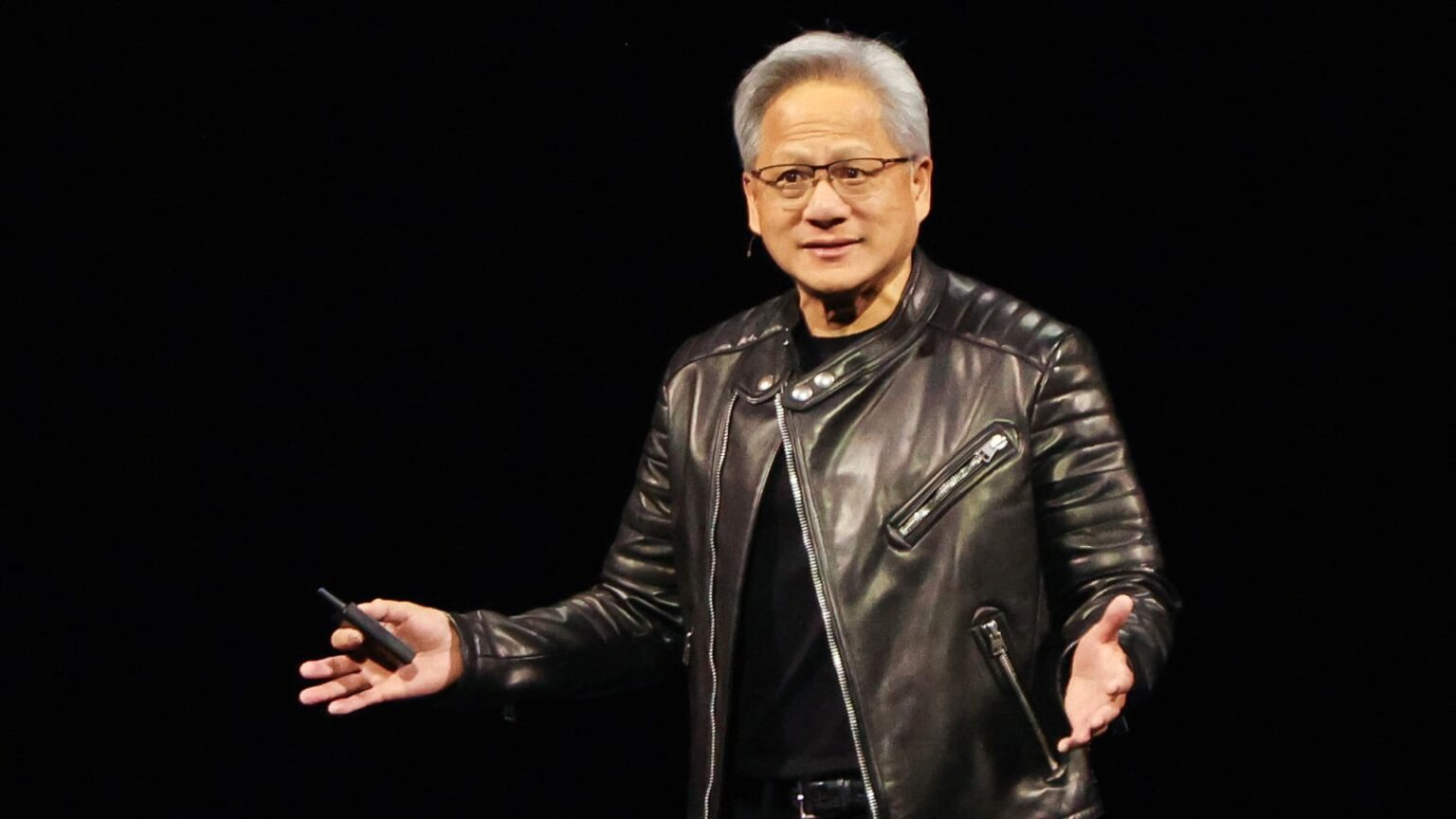

The CEO of Nvidia, Jensen Huang, offers the key note for the NVIDIA GPU Technology Conference at the Sap Center in San José, California, on March 18, 2025.

Brittany Osea-Small | Reuters

Technological actions decreased on Wednesday, led by a 5% drop in NvidiaWhile the Chipping sector indicated that the tariff plans of President Donald Trump could hinder demand and growth.

Nvidia revealed in a presentation on Tuesday that he will take a charge of $ 5.5 billion linked to export it to the H20 graphics processing countries to the countries of China and Willer and said that the Government will require a license to send to Theere and another destination.

The chip was specifically designed for the administration of the president of China, Joe Biden, to comply with the export restrictions of the United States, except for the sale of advanced AI processors, which totaled approximately $ 12 billion to $ 15 billion in revenues in 2024. Micro Advanced Devices Said in a presentation on Wednesday that the last export controls in their products MI308 could lead to a coup of $ 800 million.

Chipping actions have fought as a result of the sweeping of US commercial restrictions of President Donald Trump, caused by fear that the highest rates will quell the demand.

The disseminations of Nvidia and AMD are the first important signals that Trump’s fierce battle with China could have a significant meaning. The administration has made some exemptions for electronics, including semiconductors, but has warned that separate tariffs could come along the way.

In addition to the concerns of the sector, there was a disappointing impression of the manufacturer of Dutch semiconductor equipment ASML. The company lost orders expectations and said that tariff restrictions create uncertainty of demand. The shares fell around 5%.

He Vaneck semiconductor ETF More than 4%fell, with AMD lunch more than 5%. Microns” Marvel technology and Broadcom Around 2% each sank. Equipment manufacturers Applied materials and Lam research Around 3% fell.

The decreases extended to the broader market and to the Nasdaq compound with technological weight, which fell almost 2%. Target platforms, Alphabet and Tesla Lost about 2% each. Amazon” Microsoft and Apple They were the last less than approximately 1% each.