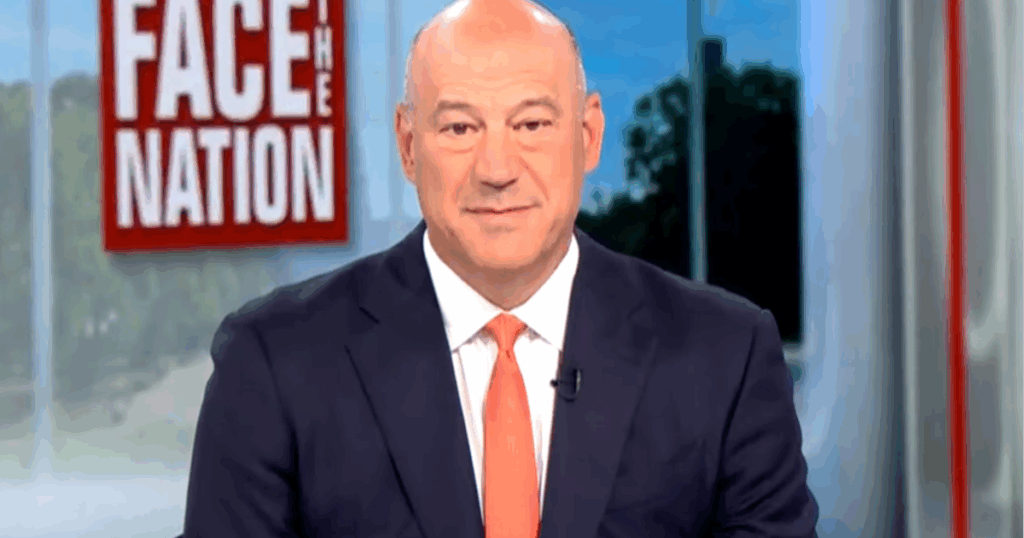

The following is the transcription of an interview with Gary Cohn, vice president of IBM and former director of the National Economic Council of the United States, which AA faces the National with Margaret Brennan “on April 27, 2025.

Margaret Brennan: And now we go to Gary Cohn, who served as the main economic advisor in the first mandate of President Trump. Now is the vice president of IBM. It’s good to have you back, Gary.

Gary Cohn: Thank you for inviting me.

Margaret Brennan: Then we saw the bouncing of the stock market market this week and, nevertheless, you see in our survey data, you see in the economic indicators that it is a real group about what is coming, only recession predictions. What are you seeing?

Cohn: So I think we need to step back here. We entered the year with an incredible euphoric emotion about what was going to happen. We also enter the year with the market of perfection. I think that now, as we move towards where we are today, we are classified or in a world where we are at a price for realistic uncertainty, and uncertainty is not good for growth. So we have gone from this emotion to unpredictability, and unpredictability has to do with where we are in the economy. And I think many of their data showed that there is still some confusion in the economy at this time. What we have seen for the beginning of the last three months, in the first internships of the presidency, is that consumers begin to be a little concerned about tariffs. The concern for tariffs has led them to pre-go or buy in front-end many of the largest items they were going to buy.

Margaret Brennan: Buy them now, because they can be cheaper than in a few months.

COHN: We have seen almost maximum car sales of historical records. Then we see people who buy cars because they are trying to avoid rates. They are buying consumption products, they are buying washing machines, they are buying technological items. So we have seen that the economy is actually in relatively good form. So, if you observe real data, what people would call hard data that leave the economy at this time, look quite solid. If you observe the softest data, and the softest data are the data of the surveys, and only showed some voting data, there is a horrible lot or data of economic surveys. It begins to see much more weakness in survey data. So, if you observe consumer confidence, consumer confidence is an indication of what I am thinking that I am going to do in the future, it begins to see much more weakness in the feeling of the consumer and in the consumer data. And I think that is beginning to play through the economy. This week, we begin to see many of the main companies in the United States to inform profits for the first quarter.

Margaret Brennan: Correct.

COHN: Now, remember that it is the other way around, the first quarter, but companies also have a vision of what is happening in the second quarter. So you started seeing that some of the main consumer -oriented brands say, look, our first quarter was quite good, but we are beginning to see signs that the second quarter is not good as we expected. We saw it in fast food restaurants like chipotle. We saw it in Snack Foods for Pepsi Cola. We saw it in the airlines. The airlines have talked about how difficult their restaurants are, and we have also seen it in the very high range product. We saw it in LVMH warns about the slowdown in sales. So we are in this part of the economy where this lack of predictability is, there is uncertainty and consumers who act in this way withdrawing from the market and only buying the essentials and require orchies to buy a great purchase life.

Margaret Brennan: or maybe not on the shelves tomorrow. That is something that we hear that some of these retail CEOs told the White House in meetings this week. And our Richard Escobedo reports that at a separate meeting, the Treasury Secretary told investors the reserve of container ships that transport goods between China and the United States, has dropped more than 60%.

Cohn: Well, we are seeing the data. We are seeing the data that come out of China and –

Margaret Brennan: That means people for people because to buy it, he won there.

Cohn: So what people need to understand is the cycle of a good being sold in China, loaded on a ship, navigated through the ocean, the United States, in a factory, distributed to a shelf, is approximately eight in the United States. So, if you return to the date of April 2 when the tariffs were activated, you are talking about seeing the effect really on May 2. So I would say the last two weeks or, or, or, or that will begin, you will begin to see this effect here. Then you know that we are a few weeks after seeing the first effects of what will happen in the transport of goods. He is also beginning to see many of the small businesses, and this is where he is really interesting, you know, small businesses that have to ask for goods, and recently saw many data from the toy industry, the toy industry, which is really small. You know, people are asking for their toys for Christmas today, they have to ask for those toys. Those toys now come with a massive rate of 145%. The vast majority of small business toy stores cannot ask for toys today because they cannot pay the 145%rate. Then they are making a conscientious decision. Or they are leaving the business or they will simply wait and see what happens. Then you are right, the secular effect of obtaining goods from this country will not feel two to four weeks.

Margaret Brennan: And there are no active commercial negotiations, according to the Treasury Secretary. There may be contact between the United States and China, but that will not be a quick solution.

COHN: That said, the Secretary of the Treasury recognized this week that the relationship between China and the United States is unsustainable. And I think we have to recognize that.

Margaret Brennan: He said the commercial war, right?

Cohn: He said, he said –

Margaret Brennan: He pumped ESO’s brakes.

Cohn: Hello. Hey I did. But at the end of the day, the commercial problem has really begun, for the better they join around China’s problem. I think that we are all beginning to realize that the country is the most goperent in the United States and for our shelves and what we would miss most would be what comes out of China.

Margaret Brennan: We knew it. You knew it.

Cohn: We have always known. We have always known.

Margaret Brennan: You told President Trump that the duration of the first mandate.

Cohn: We have known. But the fact that the Secretary of the Treasury recognizes that we are in an unsustainable situation, and we have to start negotiating with the Chinese is very important.

Margaret Brennan: they also have to say that we are ready to speak, and they are not yet altering it. In fact, the Chinese seem to really keep the line on this until now. But also because to ask him what President Trump has said because he is talking about the line of the line, he has indicated that he could live up to the Fed, the Federal Reserve, reduce interest rates so that they are composed of what lynx. He withdrew from his threat of firing the chair from the Fed. Do you think there is an interest rate cut that is necessary?

Cohn: Then I think the Fed is doing exactly what they were empowered to do. The Fed is an independent agency with a double mandate. And its double mandate, very simply declared, is full employment on one side and stable prices. And its definition of stable prices is an inflation rate in or around 2%. They are in a position at this time where they are basically in full employment, inflation to approximately 2.4%. Basically, they are saying that we have done our work at this time. So, in essence, there really is no reason for us to take action at this time. And besides that, we have this unpredictable economy. We have this potential instability. We know that the border customs patrol is beginning to collect more and more tariff money every day. We know that these costs have to feed through the economic system. We predict that this will be inflationary, even if it is only a single price shock.

Margaret Brennan: Correct.

Cohn: So there are those who say, they look, it is a unique price shock, it is not inflationary. But the only time the prices increase, if salaries are not increasing in line with the unique price movement, each American is losing purchasing power. So, if you have a fixed price salary, but the cost of goods increases once, you can buy less.

Margaret Brennan: Then, at that point, the president also says that he can pay more here, of course, but I got it in the tax cuts. In fact, the tweet when the rate was reduced, this morning said this, the income taxes of many people will be reduced or eliminated, and will focus on those who earn less than $ 200,000 a year. This is not going to be done on the day of the fallen, right?

Cohn: Look, I don’t know, I don’t know. That would be very fast for it to be done. The other thing we must understand about tariffs, and I think this is obvious, rates are very regressive. Which means that the poorest end up paying a disproportionate percentage of the rates.

Margaret Brennan: Correct.

COHN: because they spend 100% of their payment checks on the goods. Then they go to Walmart, they will go to their stores. They are buying products with their payment check. The richest people send it, save a higher percentage of their payment check. Then, tariffs will affect the poorest people more.

Margaret Brennan: We have to leave it there, Gary. Let’s see this thought.

Cohn: Okay.

Margaret Brennan: Very good, he faces the nation to return in a minute. Stay with us.