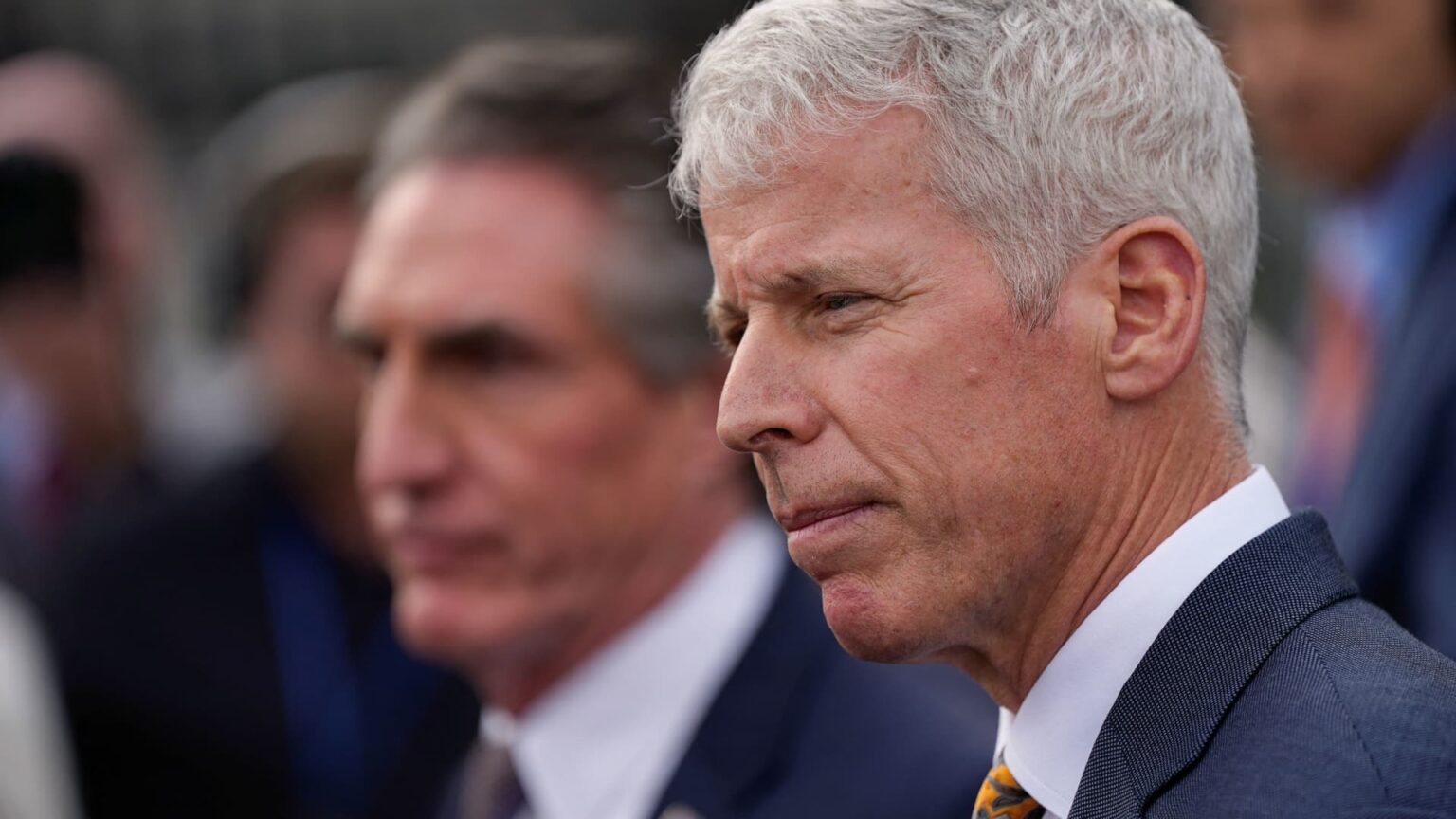

Abu Dhabi, United Arab Emirates – The Secretary of Energy of the United States, Chris Wright, is not concerned about the fall in oil prices and its impact on the United States bituminous shale oil industry, and is emphasizing that the coming years should be a moment of abundance of energy for the LORC of the world butter butter.

“The United States’s bituminous schist industry will survive and prosper,” Wright said in an interview with Dan Murphy of CNBC in the capital of the United Arab Emirates, Abu Dhabi. “But, of course,” he added, “investment decisions will adapt if prices are kept a lot to keep it so low for a long period of time. But I am an optimistic of the United States in the United States industry.”

Petroleum prices have been pressed in the midst of lower global demand, increasing uncertainty about tariffs and a greater supply in the OPEC and NO OPEC countries market, with lower income that threatens the viability of bituminous shale producers.

The June expiration contract of Global Benchmark Brent Crude was quoted at $ 63.51 per barrel on Friday at 1:43 pm in London, 0.28% more than Thursday’s agreement. The front month can We wti The contract was $ 60.26 per barrel, higher by 0.32% from the closing price of the previous day. Both contracts have dropped approximately 22% in the last year.

To make his point, Wright referred to the 2014 to 2016, Door A Boom in the schist production coincided with a lower world demand and reduced 70%oil prices. The industry was forced to deal with a wave of tide or bankruptcy.

But the Secretary of Energy tok an optimistic angle. “In 2015 and 2016, oil prices reached $ 28 twice [per barrel]And what happened? What did the United States bituminous shale industry do at that time? Innovate, get smarter, reduce its costs, and that is what is happening right now, “Wright said.

Basic products analysts estimate that American crude should be maintained above $ 65 per barrel to keep schist producers in business. Goldman Sachs reduced its oil prices for WTI of the United States this week. UU. A $ 58 per barrel in December 2025 and $ 51 per barrel in December 2026, below a previous perspective or $ 66 per barrel this year and $ 59 per barrel in 2026.

Wright himself is a former Bituminous Squis Executive, founded and served as CEO of the Denver -based oil services company, Energy Energy, until they resign to work in the administration of the president of the United States, Donald Trump. The price of Liberty Energy’s shares has suffered in the midst of falling oil prices and commercial tensions, with actions that decrease around 46% in the year to date.

The comments of the Secretary of Energy occur approximately one week after the OPEC alliance and its partners that do not produce OPEC oil, known as OPEC+, they made the shock decision to accelerate their raw production increases already planned, adding more. The decision helped further boost crude prices.

However, in the long term, OPEC+ members need higher oil prices to balance their budgets. On the contrary, Trump has promised to “pierce, baby, pierce” to keep prices for US consumers, and have a long voice on the legs about wanting OPEC members to pump more oil for that reason.

When asked if this could put the US and the OPEC in a collision course, Wright responded in the negative.

“I don’t think it’s a collision course at all. What we see and what I saw here in the EAU, and looks in Saudi [Arabia] And Qatar is a very long -term energy vision, “Wright said.

“Yes, or of course, there is an additional short -term reduction in income if you have lower prices of oil and gas. But the investments made here and the relationships that are built here, this is looking for decades in the future.”

Wright insisted that there was a general alignment in the energy strategies of the United States and its allies of the Arab Gulf rich in oil in particular, whose leaders plans to fulfill the duration of the course of his visit to the Middle East, which is a Trump for the region.

“The way to improve American life, and the citizens of the world better, is a larger energy, a more affordable energy and a much brighter and prosperous future,” Wright said. “That is the way we are. And I think certainly [the] Eau, Saudi Arabia and Qatar, I think we are all aligned in that mission. “