White House assistants are silently floating a proposal within the Republican Party of the Chamber that would raise the tax rate for people who earn more than $ 1 million to 40%, two sources familiar with the discussions told Fox Digital, salary flooded in the tips of Tipe SocialTet and eliminate Tipepe tips.

The sources emphasized that the discussions were only preliminary, and the plan is one of the many bees that spoke as a republican work of Congress to advance in the agenda of President Donald Trump through the process of budgetary reconciliation.

Trump and his White House have not yet put a position in the matter, but the idea is that beer is analyzed by their AIDS and staff in Capitol Hill.

Meanwhile, the leaders of the Republican party, including President Mike Johnson, R-La., Have publicly opposed the idea of any tax increase.

Trump opens to send violent American criminals to El Salvador prisons

The speaker Mike Johnson is working to approve President Trump’s agenda through the budget reconciliation process (Getty images)

“I am not a great admirer to do that. I mean, we are the Republican party and we are in favor of reducing taxes for all,” Johnson said the “Futures of Sunday Morning.”

A legislator of the Republican party asked about the proposal and granted anonymity to speak frankly said they would be open to support it, but preferred a higher starting point than $ 1 million.

They said the reaction was “mixed” among other republicans of the camera. But not all legislators of the House Republican Party are aware of the discussions, and it is not immediately clear that the proposal has been distributed.

Neverberthes, points out that Republicans are deeply divided on how to promulgate Trump’s tax agenda.

Know the legislators chosen by Trump to give President Johnson a republican conference of the House of Representatives

Extending the Trump Tax and Jobs Cutting Law 2017 (TCJA) and promulgate its new tax proposals is a cornerstone of the republicans’s plans for the budgetary reconciliation process.

By reducing the Senate threshold for the passage of 60 votes to 51, it allows the party in the power of avoiding the opposition to approve broad legislation that advances its own priorities, demonstrated the agreement of measures, the expense or national debt.

The extension of Trump’s tax cuts is expected to cost only billion dollars. But even if Republicans use a budget calculation to hide their cost, know as a current policy baseline, they will still have a path to follow for new policies that eliminate taxes on tips, payment of overtime and social security checks of retirees.

Hiking taxes on the ultra rich could also serve the Democrats in a difficult political situation to force them to choose between supporting Trump’s policies and opposing an idea that they have promoted for years.

The leader of the majority of the House of Representatives, Steve Scalise, also opposes increasing taxes on rich (Reuters/Mike Segar)

The higher income tax rate is currently around 37% at $ 609,351 in profits for a single person or $ 731,201 for married couples.

But increasing the rate of millionaires could be a way to pay Trump’s new fiscal policies.

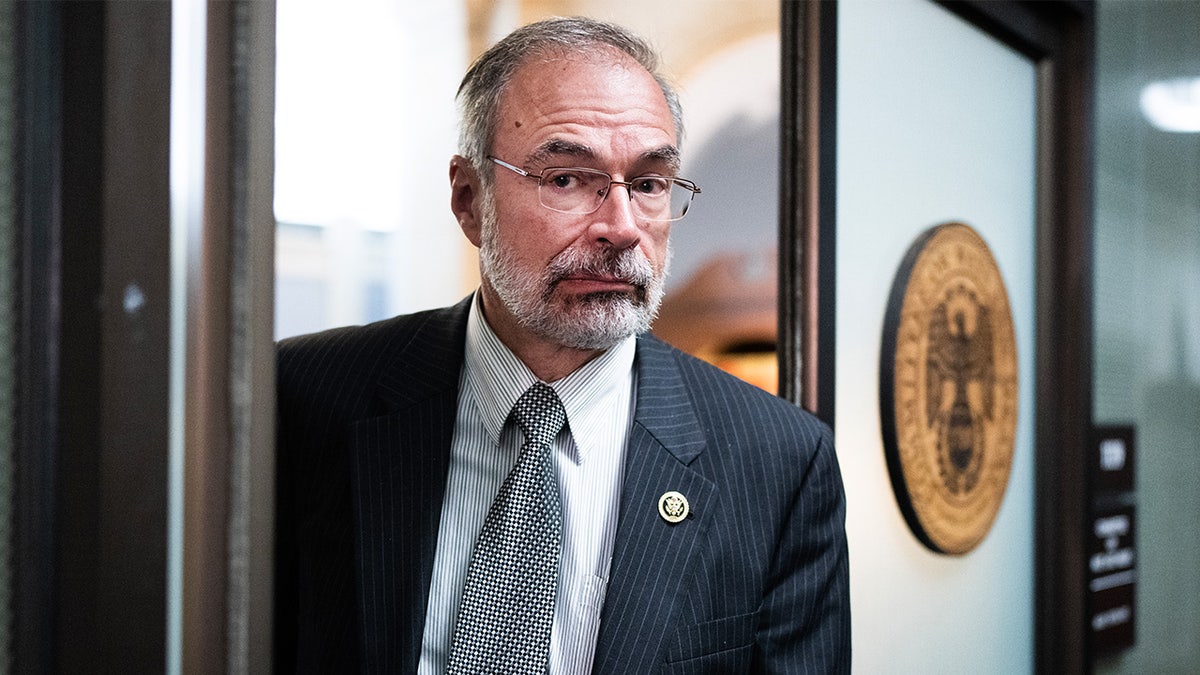

The president of the Caucus of the House Freedom, Andy Harris, R-MD., One of the hawks of the deficit that leads the load to ensure that the new expenses are combined with deep cuts in other places, said “that is a possibility.”

“What I would like to do is find expenses reductions in another part of the budget, but if we cannot obtain enough expense reductions, we will have to pay for our tax cuts,” Harris told “Mornings With María” last week.

“Before the tax and job cuts law, the highest fiscal winner was 39.6%, it was less than $ 1 million. Ideally, what we could do, again, if we can find reductions of search expenses, we say ‘OK, in accordance, restore the support, establish, establish, establish, establish, establish, establish, establish, establish, establish, establish, establish, establish, establish, establish, establish, set, set, set, set, set, set, set. reproduced.

But Johnson’s No. 2, the leader of the majority of the House of Representatives, Steve Scalise, R-La., He saw cold water over the idea on Tuesday.

“I don’t support that initiative,” said Scalishe, “in the morning with Maria,” he thought he added, “everything is on the table.”

The president of the Caucus of the House of the House, Andy Harris pointed out the openness to the idea (Getty images)

“That is why you hear that all children or ideas bounced. And if we do not take action, then you would have about 90% of Americans who see a tax increase,” Scalise warned.

Bloomberg News was the first to inform the tax increase proposal of 40% of the Republicans of the House of Representatives.

Click here to get the Fox News application

When he was contacted to comment, the White House pointed to Fox News Digital to the comments of the press secretary Karoline Leavitt on Tuesday when he said that Trump had not decided another proposal to increase the corporate tax rate.

“I’ve seen this proposed idea. I have heard this idea discussed. But I don’t think the president has determined whether or not,” Leavitt said.

Fox News Digital also contacted Johnson’s office to comment.