Admittedly, given the varying rates at which the impact of Trump economic policies, particularly tariffs but also DOGE and immigration crackdowns are progressing, it’s hard to have a good picture of where things stand in in the US and where the bottom might be. That is not merely the result of information being retrospective in what looks to be a rapidly accelerating downswing, but also small businesses and/or intermediate goods producers taking the biggest hits, which are generally not well studied.

But based on the tone of the press, discussions with people in the US, and a very recent and short trip to New York City,1 much, and arguably too much, of the US seems to be in summer of 1914 mode: cheerfully living in a sense of normalcy that is about to vanish permanently. To put it another way, if there was a sufficiently widespread appreciation of what was looming over the horizon, May 1 would have seen the launch of open-ended general strikes.

Trump really is well on his way to implementing a reactionary restructuring of the US and international economy. “The end of globalization” is too bloodless a formula to convey the severity of the dislocations that have only started to arrive.

Even in the vanishingly unlikely scenario that Trump were to abandon his tariff policies in the next week, the confusion and interruption of supplies will still have done considerable harm. The longer they remain in place, the more that damage, particularly small business closures and downsizings at small and bigger enterprises, will become permanent.

Optimists take undue solace at the idea that Trump will roll back the tariffs as he wrests concessions from other countries. First, as far as the mother of all tariff blowback is concerned, optimistic press noises about China being willing to talk are misleading. Yes, Chinese official media has acknowledged Trump Administration outreach efforts and signaled a willingness to negotiate. But China has also made clear that it is still sticking to its guns: the US must drop (which may translate into “substantially reduce”) its tariffs first. From Global Times:

In response to a question asking whether China’s Ministry of Commerce (MOFCOM) has any further information and comments as the US has repeatedly said that it is negotiating with the Chinese side on economic and trade issues and will reach an agreement, a spokesperson from the MOFCOM said on Friday that China has taken note of the repeated statements made by the US side at a high level that it is willing to negotiate with China on the issue of tariffs. At the same time, the US has recently taken the initiative to convey information to the Chinese side on a number of occasions through relevant parties, hoping to talk with the Chinese side. In this regard, the Chinese side is making an assessment.

The spokesperson said that China’s position is consistent: We will fight, if fight we must. Our doors are open, if the US wants to talk. The tariff and trade wars were unilaterally initiated by the US, and if the US side wants to talk, it should show its sincerity, and be ready to take action on issues such as correcting wrong practices and canceling the unilateral imposition of tariffs.

Now admittedly, Trump may be forced to blink soon in his China staredown due to the US need for rare earths on which China has imposed export restrictions.2 But given Trump’s massive ego, even if he were to cut China tariffs to try to get negotiations going, it seems unlikely he’d roll them back far enough in his first go to satisfy the Chinese. And if Trump eventually climbs down far enough to placate the Chinese, the Trump Administration also seems out of touch as to how long treaty and trade negotiations normally take. Given the US being famously not agreement capable and the Trump Administration not signaling an intent to retreat from its goal of diminishing China geostrategically (which may include military action), there is no reason for China to be accommodating as far as the process of reaching an agreement or its form is concerned.

In an indirect proof of how long these various tariff “deals” are taking, the Bangkok Post reported yesterday that Thailand has yet to start talks with the US, even though earlier stories made clear that these negotiations were a top government priority. So the backlog is not trivial.

Some may also take hope from the idea that Trump will soon have to bend to domestic pressure. He did, after all, waive Chinese reciprocal tariffs and even the 10% baseline tariffs on electronics, such as computers and smartphones, and also gave automakers some relief by not tariffing them for aluminum and steel on top of their 25% for imported vehicles.3 But the Trump Administration partly retreated on the China break, and is also insisting that the electronics carve-out is only short term.4

One reader even went so far as to volunteer that the plutocrats would not allow Trump to cause them undue economic harm. But so far, they don’t seem to be doing much to protect their interests.5

One would think most of them have their Congresscritters on speed dial and could get them to saddle up. Yet the Senate couldn’t even muster the nerve to pass a non-binding resolution opposing the tariffs, let alone a vote challenging the action as a violation of Congress’ supposedly sole tax prerogative. A potentially more promising route for upending the tariffs, and one not subject to Trump whims, is a series of lawsuits contesting the Trump abuse of International Economic Emergency Powers Act as providing him the authority to impose these levies.

Media reports indicated that the reason Trump relented a bit was the severity of the market action, both the stock market and the spike up in longer-dated Treasury yields. The Trump team has assumed that stock market damage would lead investors to pile into what was once the safe haven of Treasuries, instead of shunning US financial assets now that Trump the chaos generator in charge.

Despite growing evidence of pain in the real economy, like a fall in McDonald’s sales to pandemic lows, reflecting a plunge in consumer sentiment…

BREAKING: U.S. Consumer confidence slides for the fifth straight month to levels not seen since the onset of the COVID-19 pandemic. https://t.co/lFODCkjYal

— The Associated Press (@AP) April 29, 2025

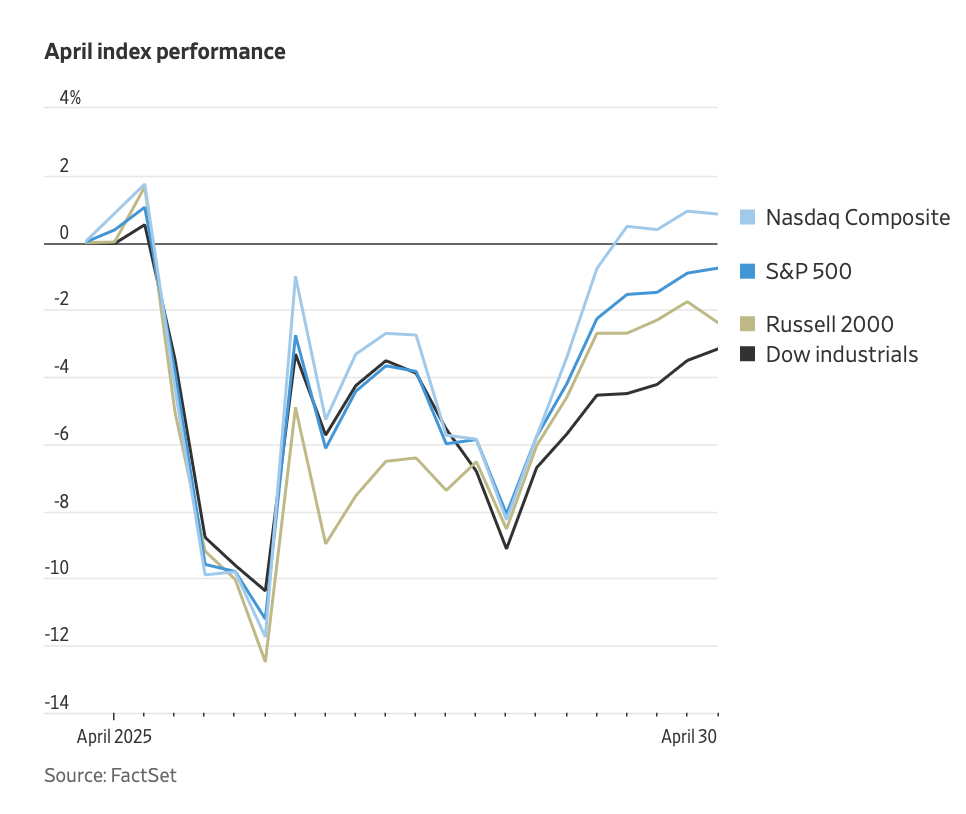

Trump is nevertheless likely cheered by the partial reversal of the stock market swoon, the ahead-of-expectations addition of 177,000 jobs in April and perhaps even by the Chinese making a big gold sale on Thursday. The chart below comes from the Wall Street Journal:

But confirming that the economic ship is still taking on more water, the Chamber of Commerce has called for broad-based tariff relief. From CNBC:

- The U.S. Chamber of Commerce is urging the Trump administration to immediately implement a “tariff exclusion process” in order to keep the U.S. economy from falling into a recession.

- The group asked trade officials Scott Bessent, Howard Lutnick and Jamieson Greer to automatically lift tariffs on all small business importers and on all products that “cannot be produced in the U.S.”

- Chamber CEO Suzanne Clark also asked the Trump administration to establish a process for businesses to quickly obtain tariff exclusions.

To get to the key point, which is the potential severity of the downside, consider, as many readers recognize, that shortages are expected to start around May 10 and first on the West Coast.

Not to be overly alarmist but…

This is one of THE BIGGEST AND MOST CRITICAL SHIPPING PORTS IN THE UNITED STATES.

These pictures were taken EARLIER THIS AFTERNOON (at 1:30pm EST)

NOTHING. IS. COMING. IN

This is what ALL OUR PORTS LOOK LIKE RIGHT NOW BECAUSE OF TRUMP’S TARIFFS pic.twitter.com/aFrcjEsEBX

— Andrew—#IAmTheResistance (@AmoneyResists) May 1, 2025

Due to how goods from Asia are trucked across the US, the impact on the East Coast for the most part will show up weeks later. Despite the cutoff of new arrivals being abrupt, the impact will be attenuated a bit due to the stockpiling at the business and even the consumer level.6

And the reason investors, businesspeople, and consumers ought to be at DefCon 1 alarm levels and aren’t? The best guess is that they assume that this Administration, like every one since the Great Depression, will saddle up and intervene to try to prevent worst outcomes.

But the Trump Team has openly and repeatedly expressed its Mellonite goals. It fully intends to tear down big swathes of the American economy, out of their cultish belief that new enterprises will quickly spring up to replace them.

But tons of commercial and investor behaviors are based on the assumption of a rescue, such as buying dips. If worst comes to worst, there will always be the Greenspan/Bernanke/Yellen put. Similarly headlines like the Guardian’s Trump’s tariffs: ‘It feels like Covid 2.0. So many things are getting disrupted’ give an unduly optimistic picture by suggesting that a Covid rerun is as bad as conditions might get.

Listen up: if Trump does not radically change course, what is coming will be much worse than Covid. Then, the US ramped up emergency programs, such as the Payroll Protection Plan and extended unemployment benefits, to preserve jobs and spending.

By contrast, Trump fully expects consumers to suffer considerably and is clearly unconcerned:

This is what tariffs actually look like.

-A $628 jacket now costs $1,797—because the tariff alone added $1,067.– A $90 shirt jumps to $276—not from taxes, not from shipping—but from a $154 tariff.

– A $167K import now comes with a $255K tariff bill.

Tariffs aren’t some… pic.twitter.com/OnxGKF7T7z

— Agent Self FBI (@RetroAgent12) May 1, 2025

The President’s point — that tariffs make it harder for families to afford as many dolls — has far bigger consequences than he’s letting on.

Let me explain once in very personal language, and then again using the more clinical language of economics. https://t.co/ttlQrgvS7Y pic.twitter.com/Ubj2klbzpu

— Justin Wolfers (@JustinWolfers) May 1, 2025

Because Trump is particularly attached to his America circa 1890 idealism and has surrounded himself with like-minded ideologues, he can’t be expected to reverse course on his tariffs, except at the margin, and then slowly. Even a considerable retreat seems likely to leave in place his 10% tariffs globally, with higher levies on China. Remember that Trump is seriously considering the insanity of putting tariffs on pharmaceuticals.

On top of that, his inability to admit error would translate into late and limited relief efforts. And he would feel constrained by the deficit. Tax receipts are sure to plunge in the absence of a tariff walkback. They fell by nearly 1/3 during the financial cricis when the annualized rate for 4Q GDP growth was -8.9%, from $1.6 trillion in 4Q 2007 to $1.1 trillion in 1Q 2009:

I spitballed to an economist colleague that if Trump didn’t course correct in a big way, it was not impossible for the US to suffer a 15% GDP contraction. He did not disagree. Even a Serious Economist like Noah Smith has mentioned hyperinflation as a possible worst case scenario for Trump policies.7

However, the oligarchs might resort to the other option before that outcome is baked in.

The Trump Team is not good at low-cost relief measures, such as credible pep talks to investors. From the Financial Times early this week:

Donald Trump’s top economic adviser Stephen Miran struggled to reassure leading bond investors in a meeting last week that followed a bout of intense tumult on Wall Street triggered by the president’s tariffs.

Miran, chair of the Council of Economic Advisers, met representatives from top hedge funds and other major investors at the White House’s Eisenhower Executive Office building on Friday, said people with direct knowledge of the matter.

Some participants found Friday’s meeting counter-productive, with two people describing Miran’s comments around tariffs and markets as “incoherent” or incomplete, and one of them saying Miran was “out of his depth”.

“[Miran] got questions and that’s when it fell apart,” said one person familiar with the meeting. “When you’re with an audience that knows a lot, the talking points are taken apart pretty quickly.”

We have not even factored in the impact of DOGE, which does not simply cut government jobs but far more important, guts programs and cashiers seasoned employees who could play essential roles in what would amount to economic relief efforts.

Satyajit Das, in his important two part series (see here and here) set forth other reasons why the coming crisis may prove to be intractable. On the finance/banking side, recall that the 2008 crisis, brewed in spots well watched by the authorities, subprime securities and related credit default swaps. Oddly they missed that this was a derivatives crisis, and that those derivatives exposures were concentrated at highly leveraged, systemically important financial institutions. But the fact that the September 2008 seizure struck at the heart of the financial system meant that government first responders knew where to administer emergency relief (the total botching of reforms is a separate, if deadly serious, matter).

This time, many more types of loans are implicated, such as so-called private credit, which is mainly lending to private equity deals and commercial real estate. And this time, the shadow banking system of non-bank lenders is far more important. Admittedly, enough distress among these non-bank lenders will later if not sooner produce enough insolvencies so as to impair bank loans. And remember that it does not even take an actual bank crisis but the fear of one to create bank runs. However, it is possible that the US will see a lending/institutional investor crisis (particularly among public pension funds) before a banking crisis takes hold.

In other words, the downside risk of Trump’s demolition project is far greater than anyone seems willing to admit. Too many people are operating on the optimistic assumption that somehow that can’t or won’t happen. Tinkerbell thinking didn’t have much success in the runup to the 2008 crisis. It is unlikely to fare better now.

_____

1 The plane to NYC was pretty full and my hotel was fully sold out, countering press reports of a collapse in US tourism. Admittedly NYC may be a lagging indicator. But restaurants seemed reasonably busy and the one luxury store I visited, very busy, and with buyers, not just lookers. NYC may also be buffered for the moment by the fact that big Wall Street firms are making out well on Trump-induced market volatility. But the “things don’t seem that bad” appearance in Manhattan may also be influencing press coverage since NYC is still the heart of the business press and to a large degree, national media.

2 From the Center for Strategic and International Studies:

Q2: What is the significance of the focus on heavy rare earths given U.S. supply chain vulnerabilities?

A2: The restrictions apply to seven medium and heavy rare earths: samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium. The United States is particularly vulnerable for these supply chains. Until 2023, China accounted for 99 percent of global heavy REEs processing, with only minimal output from a refinery in Vietnam. However, that facility has been shut down for the past year due to a tax dispute, effectively giving China a monopoly over supply. China did not impose restrictions on light rare earths, for which a more diverse set of countries undertake processing.

Q3: Why are rare earths significant to U.S. national security?

A3: REEs are crucial for a range of defense technologies, including F-35 fighter jets, Virginia- and Columbia-class submarines, Tomahawk missiles, radar systems, Predator unmanned aerial vehicles, and the Joint Direct Attack Munition series of smart bombs. For example, the F-35 fighter jet contains over 900 pounds of REEs. An Arleigh Burke-class DDG-51 destroyer requires approximately 5,200 pounds, while a Virginia-class submarine uses around 9,200 pounds.

The United States is already on the back foot when it comes to manufacturing these defense technologies. China is rapidly expanding its munitions production and acquiring advanced weapons systems and equipment at a pace five to six times faster than the United States. While China is preparing with a wartime mindset, the United States continues to operate under peacetime conditions. Even before the latest restrictions, the U.S. defense industrial base struggled with limited capacity and lacked the ability to scale up production to meet defense technology demands. Further bans on critical minerals inputs will only widen the gap, enabling China to strengthen its military capabilities more quickly than the United States.

Q4: Is the U.S. rare earths industry ready to fill the gap in the event of a shortfall?

A4: No. There is no heavy rare earths separation happening in the United States at present. The development of these capabilities is currently underway. In its 2024 National Defense Industrial Strategy, the Department of Defense (DOD) set a goal to develop a complete mine-to-magnet REE supply chain that can meet all U.S. defense needs by 2027.

3From the New York Times:

President Trump plans to sign an executive order Tuesday that will walk back some tariffs for carmakers, administration officials said, removing some levies that Ford, General Motors and others have complained would backfire on U.S. manufacturing by raising the cost of production and squeezing their profits.

The changes will modify Mr. Trump’s tariffs so that carmakers who pay a 25 percent tariff on imported cars are not subject to other levies, for example on steel and aluminum, officials said in a call with reporters Tuesday.

Carmakers will also be able to qualify for tariff relief for a proportion of the cost of their imported components, though those benefits will be phased out over the next two years.

4 The Administration messaging is so confused it is hard to know where things stand. From Associated Press on April 14:

Late Friday, the U.S. Customs and Border Protection said that electronics, including smartphones and laptops, would be excluded from broader, so-called “reciprocal” tariffs — meaning these goods wouldn’t be subject to most tariffs levied on China to date or the 10% baseline levies imposed on other countries.

But U.S. Commerce Secretary Howard Lutnick later said that this was only a temporary reprieve — telling ABC’s “This Week” on Sunday that electronics will be included under future sector-specific tariffs on semiconductor products, set to arrive in “probably a month or two.”

And not all of the levies that the U.S. has imposed on countries like China fall under the White House’s “reciprocal” categorization. Hours after Lutnick’s comments, Trump declared on social media that there was no “exception” at all, adding to confusion. Trump instead argued that these goods are “just moving to a different” bucket. He also said that China will still face a 20% levy on electronics imports as part of his administration’s prior move related to fentanyl trafficking.

5Perhaps they are getting tips so they can front run executive orders?

6 Yours truly stockpiled. And I don’t believe Apple for one second in claiming they saw no forward buying of iPhones. I saw refurbished iPhones thin out markedly during my short visit.

7 Smith is orthodox, so he does not grok that it’s not the much-demonized “printing” that would cause hyperinflation, but the Trump destruction of productive capacity, which looks to be a feature of his program.