Does Trump need the adrenaline boost of getting in a new fight to make his day complete, as well as keep his name in the headlines? We’ll recap some of the latest developments in his tariff war.

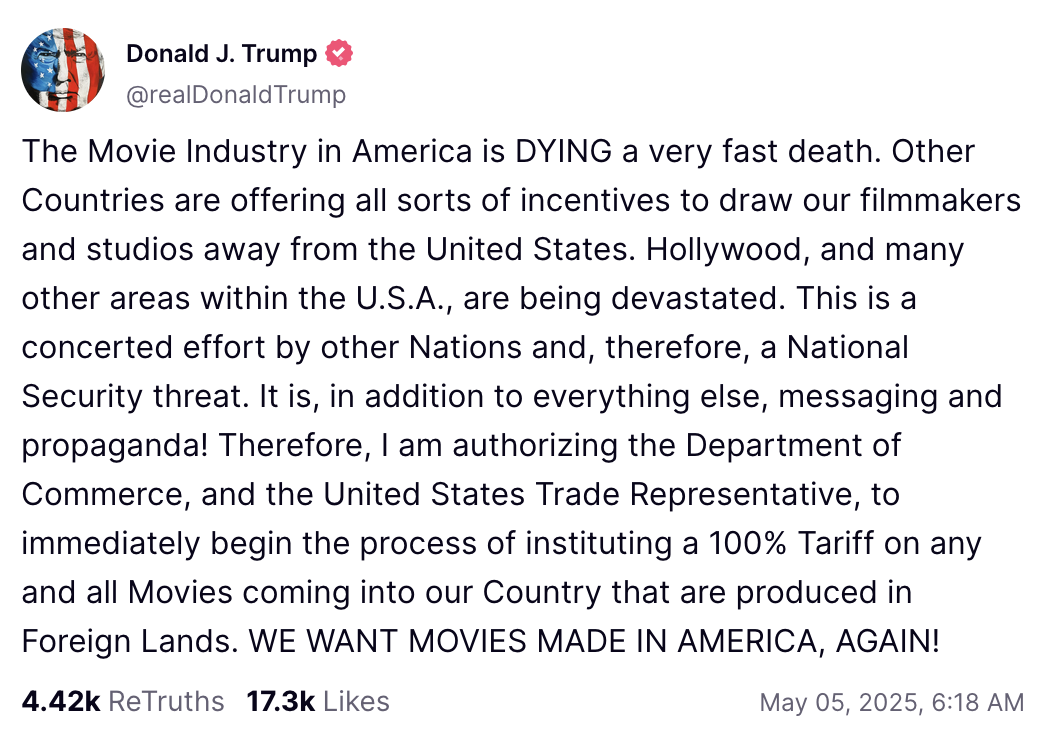

Bye bye foreign films? First, to Trump’s latest attention-grabbing row of putting 100% tariffs on foreign movies. His Truth Social rant:

Of course, Trump and his ilk would never consider what neoliberalism has done to fiction publishing and the theater in the US, and that the endless milking of action franchises has turned off a lot of once-loyal movie viewers.1 No, it’s those conniving furrniers! From BBC:

US President Donald Trump says he will hit movies made in foreign countries with 100% tariffs, as he ramps up trade disputes with nations around the world.

Trump said he was authorising the US Department of Commerce and Trade Representative to start the process to impose the levy because America’s movie industry was dying “a very fast death”.

He blamed a “concerted effort” by other countries that offer incentives to attract filmmakers and studios, which he described as a “National Security threat.

Foreign movies as a national emergency? Seriously? But does anyone have the staying power to sue?

More from the BBC:

But the details of the move are unclear. Trump’s statement did not say whether the tariff would apply to American production companies producing films abroad.

Several recent major movies produced by US studios were shot outside America, including Deadpool & Wolverine, Wicked and Gladiator II.

It was also unclear if the tariffs would apply to films on streaming services, like Netflix, as well as those shown at cinemas, or how they would be calculated.

The governments of Australia and New Zealand have spoken out in support of their countries’ film industries.

Reuters gives more detail on foreign production:

In January, Trump appointed Hollywood veterans Jon Voight, Sylvester Stallone and Mel Gibson to bring Hollywood back “bigger, better and stronger than ever before.”

Movie and TV production has been exiting Hollywood for years, heading to locations with tax incentives that make filming cheaper.

Governments around the world have increased credits and cash rebates to attract productions and capture a greater share of the $248 billion that Ampere Analysis predicts will be spent globally in 2025 to produce content.

So how does one count the origin of a movie with AI actors? Will the ability to classify a considerably AI movies as American if American-managed/funded accelerate this trend? And as for Netflix, I’ve never been a fan of streaming and hope my DVD collection proves to be adequate.

De minimus exemption ends….whacking lower income consumers as well as Meta and Facebook. NBER confirmed that the end of this exemption on shipments will hit lower income buyers hard.

A U.S. consumer can import $800 worth of goods per day free of tariffs and administrative fees. Fueled by rising direct-to-consumer trade, these “de minimis” shipments have exploded in recent years, yet are not recorded in Census trade data. Who benefits from this type of trade, and what are the policy implications? We analyze international shipment data, including de minimis shipments, from three global carriers and U.S. Customs and Border Protection. Lower-income zip codes are more likely to import de minimis shipments, particularly from China, which suggests that the tariff and administrative fee incidence in direct-to-consumer trade disproportionately benefits the poor. Theoretically, imposing tariffs above a threshold leads to terms-of-trade gains through bunching, even in a setting with complete pass-through of linear tariffs. Empirically, bunching pins down the demand elasticity for direct shipments. Eliminating §321 would reduce aggregate welfare by $10.9- $13.0 billion and disproportionately hurt lower-income and minority consumers.2

Trump and his fellow travelers really do hate the poors.

CNN was more dramatic. From A massive tariff on millions of Americans’ purchases just went into effect — cue the chaos:

CBP [Customs and Border Patrol] told CNN it currently processes “nearly 4 million duty-free de minimis shipments a day.” Research indicates that a majority of those shipments come from China and Hong Kong. In total, over the last fiscal year, CBP said 1.36 billion packages came to the US under the de minimis exemption…

Regular Temu and Shein shoppers told CNN this week they’ve increasingly turned to the site as they feel made-in-the-USA products have gotten out of reach.

“I can’t afford to buy from Temu now, and I already couldn’t afford to buy in this country,” Rena Scott, a 64-year-old retired nurse from Virginia, previously said to CNN Business.

Lower-income households will suffer the most from the end of cheap Chinese e-commerce sites. About 48% of de minimis packages shipped to the poorest zip codes in the United States, while 22% were delivered to the richest ones, according to February research from UCLA and Yale economists.

But it’s not as if some US big fish will escape collateral damage. From the New York Times:

Sky Canaves, a principal analyst for retail and e-commerce at the research firm eMarketer, said ads from Temu and Shein were once “inescapable” on search, social media and applications. But that is changing…

Over a two-week period starting March 31, Temu spent 31% less on US daily advertising on Facebook, Instagram, TikTok, Snap, X (formerly Twitter) and YouTube compared with its average daily spending on those platforms in the previous 30 days, according to estimates from the market intelligence firm Sensor Tower. Shein’s daily advertising outlays on its social networks in the United States were down 19% over the same two weeks.

Temu and Shein, which had flooded Google in the United States with ads for the goods they sell, started to disappear from the platform in April. On April 5, Temu accounted for 19% of all US ads displayed on Google Shopping, but that figure dropped to zero a week later, according to research by the marketing firm Tinuiti. Shein went from about 20% in early April to zero by April 16.

And of course, the closing of this loophole will harm some small businesses. Resilc confirms: “I have several maker3 friends who get their parts this way. No mo.”

Trump rejects breaks for small businesses. This critically important tidbit is buried in an Axois story we’ll return to later in this post. The reason this matters is that the Chamber of Commerce sent want amounted to a Defcon 1 level alert, describing the need to give many waivers to small businesses. As we and many others have pointed out, they are vulnerable by generally having less in the way of funding reserves and borrowing capacity. And they are important to the health of the country, both by regularly being the driver of jobs growth, as well as often the makers of intermediate goods that are important to supply chains. From Axois:

The intrigue: Trump said that there would be no tariff exemptions for small businesses.

- “They’re not going to need it,” he said, despite a letter from the U.S. Chamber of Commerce that warned of catastrophic consequences for small businesses from the tariffs.

- The massive lobbying group >asked the administration to create a tariff exclusion process that could help some of the businesses.

- A separate group that lobbies on behalf of footwear companies also asked for industry relief earlier this week.

Financial Times talks up Chinese tariff evasion via Southeast Asia. Given that tariffs on goods from Southeast Asian countries are set to range from 10% for Singapore to 49% for Cambodia,4 trans-shipments, even if they could be executed without causing a world of hurt for buyers, would only provide some relief. And the pink paper does not suggest that low-tariff Singapore could be a smuggling route.

Note that there were some dismissive remarks in the Financial Times comments section. First (as you will see) the story relies entirely on the existence of tariff-evading schemes promoted in Chinese social media. These readers contend these ads are long standing and if anything have been running less frequently of late. Second, some in the international shipping industry say no reputable ship operator or buyer would take this sort of liability, which suggests this sort of tariff-busting (beyond the games played already) is not likely to become a large-scale activity.5 Nevertheless, from the lead story in the Financial Times, Chinese exporters ‘wash’ products in third countries to avoid Trump tariffs:

Chinese exporters are stepping up efforts to avoid tariffs imposed by US President Donald Trump by shipping their goods via third countries to conceal their true origin.

Chinese social media platforms are awash with adverts offering “place-of-origin washing”, while an inflow of goods from China has raised alarm in neighbouring countries wary of becoming staging posts for trade actually destined for the US.

The article mentioned Malaysia and quoted a source that depicted its customs as being lax. But other countries were tightening up. Again from the Financial Times:

Vietnam’s industry and trade ministry last month called on local trade associations, exporters and manufacturers to strengthen checks on origins of raw materials and input goods and to prevent the issuing of counterfeit certificates.

Thailand’s foreign trade department also last month unveiled measures to tighten origin checks on products bound for the US in order to prevent tariff evasion.

Trump continues “deal just around the corner” patter while signaling tariffs set to remain. Given how well that posturing worked out with the (immediately broken) Israel ceasefire, the Ukraine war negotiations, and now the Iran nuclear enrichment talks, one has to severely discount Trump “deal almost here” messaging. But Wall Street seems to be a true believer. Any excuse to buy a dip, one assumes.

If you read some of the stories with care, you can see not much has changed.

We had assumed Trump would keep tariffs on permanently, say at his present 10% default (unless he was able to wrest a very big economic and/or military concession from a particular country) and 25% tariffs against China even in the event of a major economic implosion. He has too much ego invested in his tariff scheme ever to retreat fully.

Axois confirmed our belief. From Trump says tariffs could be permanent, but strikes softer note on China:

President Trump said Sunday he would need to keep at least some tariffs on foreign goods in place to convince businesses to move production to the U.S.

Why it matters: It suggests that the historic levies on nearly all goods coming into America would remain in some form — even as the White House says it intends to strike trade deals with a slew of nations, including China.

- Such a development would be a huge blow for the economy. It can take years for companies to re-shore manufacturing — and doing so would likely result in higher costs for businesses and consumers.

What they’re saying: Trump told NBC’s “Meet the Press with Kristen Welker” that he would not rule out the possibility that the tariffs announced in recent weeks might stick.

- “No, I wouldn’t do that because if somebody thought they were going to come off the table, why would they build in the United States?,” Trump said in an interview that aired on Sunday.

- Trump said auto companies — including Toyota and Ford — have announced plans for additional U.S. plants in the wake of tariff policy.

Axois described Trump continuing his attack on toy-makers and parents:

Trump doubled down on those views on Sunday: “We don’t have to waste money on a trade deficit with China for things we don’t need, for junk that we don’t need.”

The Axois headline depicted Trump as taking a “softer” line on China. I have difficulty with this positioning. This is the same nonsense that Trump tried with Russia: depicting Putin as in desperate need of a deal because Russia was taking large battlefield losses and its economy was suffering. But Russia before and China now, and not Trump, are the judges of how eager they are to make concessions to the US. This is yet more patter for a US business audience, to try to signal that relief is not that far away when the Chinese have not indicated any change in stance, which is that the US has to drop tariffs (one assumes they don’t mean all but quite a lot) before China will talk. Again from Axois:

Yes, but: He conceded it was impractical to keep the tariffs on China at their current rates.

- “At some point, I’m going to lower them because otherwise, you could never do business with them. And they want to do business very much. Look, their economy is really doing badly. Their economy is collapsing.”

….

What to watch: Trump in recent days has tempered his tone on China, signaling willingness to strike a trade deal.

- “They want to make a deal. They want to make a deal very badly. We’ll see how that all turns out, but it’s got to be a fair deal,” Trump said.

Bloomberg showcases more Trump palaver in Trump Suggests Some Trade Deals May Come as Early as This Week:

President Donald Trump suggested that his administration could strike trade deals with some countries as soon as this week, offering the prospect of relief for trading partners seeking to avoid higher US import duties.

“It could very well be,” Trump told reporters on Sunday when asked whether any trade agreements were coming this week. He didn’t specify any countries.

“We’re negotiating with many countries, but at the end of this, I’ll set my own deals — because I set the deal, they don’t set the deal,” Trump said aboard Air Force One. “You keep asking the same question: ‘When will you agree?’ It’s up to me, it’s not up to them.”

There’s no evidence that The Don as Dealmaker King is working all that well.6 There were rumors that “a deal” was on the verge of being announced last week, with the supposed holdup the need for approval in the counterpart country. One would think that means legislative approval. Yours truly is not omniscient but I have yet to see any press accounts along those lines. Some wags though the country that was set to go first was India due to having very high duties on US car imports.

Consider a few examples:

This Japanese MP (whose name is Shinji Oguma) absolutely nails it, and reflects what pretty all countries in Asia are thinking: pic.twitter.com/U1jZahc5Sh

“When Japan negotiates with what [Trump] is saying it’s akin to being extorted by a delinquent.

If Japan gives in, thinking…

— Arnaud Bertrand (@RnaudBertrand) April 18, 2025

Japan, the most likely country to bend the knee is not backing down when faced with extortion from the US.

Japan trade representative states that eliminating all new tariffs are non-negotiable. pic.twitter.com/v8qbW2j1GM

— Zhao DaShuai 东北进修🇨🇳 (@zhao_dashuai) April 20, 2025

Countries in Southeast Asia have no doubt taken note of the US’ very rough handling of top ally Japan. They also know that Vietnam went to the US quickly, with the offer of dropping all tariffs on US goods and was rebuffed. Although this may not have been the reason, Thailand cancelled a trip to the US for negotiations on April 237.

I wrote to a well-connected economist colleague, sputtering over a lead story in the Wall Street Journal story over the weekend, that depicted the US economy as “powering” through the Trump tariffs. Note that he’s been much more sanguine about where things might go, believing that there are good odds that Trump will pull out of his controlled flight into terrain. My e-mail, subject line “This is the last thing the US needs”:

See below as a lead story in the WSJ plus the market bounce will encourage Trump to stick with his tariffs even as the damage becomes irreversible (business closures, which are already starting).

You may have seen the Chamber of Commerce sounding a DefCon1 alert and pleading for (many many) specific waivers

This is an effect of the stockpiling, both the pulling demand forward at the consumer and business level, and the stockpiling postponing the onset of shortages.

You see at the FT that Buffett is still selling stocks.

And Trump is nowhere on negotiating. The Bangkok Post the US hsn’lt even set a time to deal with Thailand. From 3 days ago. The PM dropped some other initiatives as soon as the tariffs were announced and said the negotiations were her top priority.

https://www.bangkokpost.com/business/general/3014792/bank-of-thailand-cuts-rate-as-tariff-storm-darkens-outlook.

Nikkei reports SE Asian states have little to give the US save more LNG buys.

His reaction: “Yup.” He does tend to the laconic.

_____

1 Book publishers once had a healthy “mid list” business, of books on which they paid reasonable but not hefty advances for works they expected to sell 5,000 to 25,000 copies. That would in aggregate be enough for them to pay for themselves, plus a few could be expected to break out and become bestsellers.

For reasons I do not fathom (and it does not seem entirely due to e-publishing, since the original sharp falloff in printed books has substantially reversed itself), the mid-list business has collapsed.

Similarly, my impression is that off Broadway, which is also a source of movie scripts, has been suffering. I know personally a writer (and a good one) who had to quit producing plays (the writer would often have to help raise the funds) because it was too tenuous an existence (their transition to Los Angeles TV writing was initially successful even though it felt like a big step down, but that line of work has also become imperiled). If nothing else, ever levitating real estate rental costs would raise the cost of mounting a show.

2 More detail from the NBER paper:

In recent years, de minimis imports have exploded, fueled by streamlined customs processing, high tariffs, and an emergent type of international trade that ships directly to consumers purchasing through online retail platforms. For such transactions, online orders bypass domestic warehousing and are shipped directly to consumers (often referred to as “direct-to-consumer” or “drop ship” shipments).

To get a sense of de minimis’ rising importance, in 2023, these imports totaled $54.5 billion over 1 billion shipments, up from just $0.05 billion over 110 million shipments in 2012. When compared against relevant benchmarks, in 2023 de minimis imports were 7.3% of U.S. imports of consumer goods and 4.9% of E-commerce sales, a substantial increase from just 0.7% and 1.0%, respectively, from before the trade war.

De minimis is an integral logistics strategy of some of the world’s largest and fastest-growing retailers, such as Shein and Temu, that ship directly to consumers. Five legislative proposals to pare back §321 were recently introduced in Congress, and in September 2024 an Executive Order was issued to rescind the de minimis exemption on shipments containing products subject to 2018-19 tariffs.

The growth of low-value shipments and related policy concerns are a global phenomenon….

Who benefits from direct-to-consumer and de minimis trade? What are the aggregate and

distributional welfare consequences of potential changes to §321 trade policy?.. We rely on a novel

dataset encompassing the universe of shipments into the U.S. handled by three global carriers.

3 From Wikipedia:

The maker culture is a contemporary subculture representing a technology-based extension of DIY culture[1] that intersects with hardware-oriented parts of hacker culture and revels in the creation of new devices as well as tinkering with existing ones. The maker culture in general supports open-source hardware. Typical interests enjoyed by the maker culture include engineering-oriented pursuits such as electronics, robotics, 3-D printing, and the use of computer numeric control tools, as well as more traditional activities such as metalworking, woodworking, and, mainly, its predecessor, traditional arts and crafts.

The subculture stresses a cut-and-paste approach to standardized hobbyist technologies, and encourages cookbook re-use of designs published on websites and maker-oriented publications.[2][3] There is a strong focus on using and learning practical skills and applying them to reference designs.[4] There is also growing work on equity and the maker culture.

I assume there is a profit, if modest, or at least cost recovery objective since Wikipedia reports on “maker faires” and participants can sell or license their works for payment.

4 Specifically: Cambodia 49%, Laos,48, %Vietnam 46%, Myanmar 44%, Thailand 36%, Indonesia 32%, Brunei and Malaysia 24%, the Philippines 17% and Singapore 10%

5 For instance:

Bounded Rationality

This is where the reputation of arbitrariness turns into a positive. Any nation suspected of wash knows fully well that they will also be targeted likewise. Individuals will always have an incentive to engage in such obfuscation, but the nations know that US administration will be looking at ∂import. Besides, the Chinese margins are thin.Washing the origin (just like money laundering) has significant costs. Money laundering works because the gain to the malefactor are immense (zero ability to spend to a 75-80% ability). Here, gains is minimal and the risk to the colluding nation is large. I cannot see this working.

ITD

If properly enforced a certificate of origin would sink that idea immediately. Shipping goods made in country A as being form country B only by rerouting is completely illegal. Good luck to the importer in the US who is taking an enormous risk. Plus the current administration will have to charge the same high tariffs from all countries in SEA thus destroying their economy completely. Any government in SEA that closes an eye to this will be hit very hard. You cannot play this on scale, it’s impossible. We do thousands of containers a year and no way you can risk such an illegal scheme.

6 Bloomberg, later in the linked story, repeated the Trump misrepresentation “his aides are having conversations with counterparts from China.” Global Times repeated (as in validated) social media rumors that Trump officials were making entreaties to China, but pointedly did not signal any change in China’s posture.

7 The Bangkok Post reports a remarkable amount of tap-dancing by the Prime Minister, such as admitting that no date for negotiations has yet been set (!!!), trying to claim that informal talks amount to secret negotiations (contradicting the Trump claim that he will be involved at least in the final contours of an agreement and is The Decider), that the agreement will ultimately be secret: “However, any secret collaboration cannot be disclosed as other countries which are in talks with the US will know and comparisons will be made and turmoil will follow,” she said.”

It is rather hard to see how there can be any secret collaboration given that no talks are actually taking place, just feelers. And Nikkei in a May 2 article argued that Southeast Asian countries don’t have much they can offer the US aside from LNG buys:

Asian economies are set to use imports of U.S. energy resources as leverage in negotiations with U.S. President Donald Trump to back down from his hefty “reciprocal” tariffs, but concessions in other areas like automobiles and agriculture could prove harder, observers say.

“Asian trading partners have been the most forthcoming in terms of doing the deals,” Scott Bessent, the U.S. Treasury Secretary and Trump’s chief tariff negotiator, said on Tuesday, singling out India, South Korea and Japan.

The U.S. announced in April that it would pause threatened tariffs for 90 days. With the exception of China, which has imposed retaliatory tariffs against the U.S. already, more than 100 countries and regions are rushing to negotiate in order to mitigate the possible fallout.

Negotiations have already begun with Vietnam, Japan, Indonesia, South Korea and India, and are set to increase in the coming weeks well ahead of the July 9 deadline.

Having said that, the PM is confident that the US and Thailand will reach an agreement before the 90 day pause on the 36% tariffs has been reached.